The past few years have been a rollercoaster ride for businesses, and the economic impact of the COVID-19 pandemic is still being felt. Many businesses and individuals faced financial difficulties, leading to delayed or missed payments. Now, as the world slowly returns to a semblance of normalcy, a critical question arises: How can you navigate the complexities of late payments and clear your financial slate after the pandemic?

Image: cashier.mijndomein.nl

This comprehensive guide will equip you with the knowledge and tools to craft compelling late payment removal letters due to COVID-19. We’ll delve into the nuances of writing such letters, the essential elements to include, and the strategies to employ to increase your chances of success. So, let’s dive in and empower you to reclaim your financial stability.

Understanding the Power of a Late Payment Removal Letter

A late payment removal letter is a formal request to a creditor, such as a bank, credit card company, or utility provider, to remove a late payment from your credit report. While a late payment may seem like a minor blemish, it can have a significant negative impact on your credit score. A lower credit score can lead to higher interest rates on loans and credit cards, making it more difficult to secure financing in the future.

In the aftermath of COVID-19, many creditors have shown understanding and flexibility toward individuals and businesses struggling with payments. The good news is that you’re not alone and there are resources available to help you. Carefully crafted late payment removal letters can serve as a powerful tool to negotiate with creditors and potentially remove late payments from your credit history, paving the way for a healthier financial future.

When is a Late Payment Removal Letter a Good Idea?

Before drafting a late payment removal letter, it’s crucial to evaluate your situation and determine if this approach is right for you. Here are some instances where a late payment removal letter can be particularly beneficial:

- COVID-19 Related Hardship: If your late payments were directly caused by job loss, business closure, or illness due to the pandemic, you have a strong argument for removal. Documenting these circumstances with supporting evidence is vital.

- Limited Late Payment History: If you have a generally strong credit history with only a few late payments, a removal letter may be more likely to be successful.

- Positive Payment History After the Late Payment: Demonstrating a consistent track record of making timely payments after the late payment could enhance your request.

- Negotiation or Compromise Potential: If you’re open to discussing payment plans, settlements, or other alternatives with the creditor, it can increase your chances of having the late payment removed.

Crafting a Compelling Letter

The key to a successful late payment removal letter lies in its ability to convey your situation clearly, demonstrate your commitment to resolving the issue, and create a sense of urgency and goodwill. Here’s a breakdown of the essential elements to include:

Image: cbselibrary.com

1. Clear and Concise Introduction

Start by clearly stating your purpose in the first paragraph: to request the removal of a specific late payment from your credit report.

Example:

“Dear [Creditor Name],

This letter is to formally request the removal of a late payment from my credit report, dated [date of late payment]. The late payment was related to account number [account number], and I understand the impact it has had on my credit score.”

2. Explain the Circumstances Behind the Late Payment

This is where you lay out the details of why the late payment occurred. Be straightforward, honest, and factual. This is not the time for excuses or blame.

Example:

“The late payment was a result of [briefly explain the reason – e.g., job loss due to COVID-19, unforeseen medical expenses, business interruption.] Due to [reason], I was unable to make the payment on time. I understand that timely payments are crucial, and I apologize for any inconvenience this may have caused.”

3. Highlight Your Commitment to Resolution

Demonstrate that you are taking proactive steps to address the situation and ensure it won’t happen again. This might include:

- Paying off the outstanding balance in full or setting up a payment plan.

- Making all subsequent payments on time.

- Demonstrating a positive payment history since the late payment occurred.

Example:

“I have been making all payments on time since [date of last on-time payment] and am committed to maintaining a positive payment history moving forward. I have already caught up on the missed payments and am confident I can continue to make timely payments in the future. “

4. Provide Supporting Documentation

If applicable, include any supporting documentation that validates your situation. This could include:

- Letters of termination from employment.

- Medical bills related to COVID-19.

- Proof of participation in any hardship programs offered by your employer or government.

5. Closing and Call to Action

Conclude your letter by reiterating your request for removal, expressing your appreciation for their consideration, and providing contact information for prompt follow-up.

Example:

“I kindly request that you consider removing the late payment from my credit report. I believe my situation warrants this consideration and I am confident I can continue to maintain a positive payment history going forward. Please feel free to contact me at [phone number] or [email address] to discuss this further. Thank you for your understanding and time.”

6. Proofread Carefully

Proofread your letter meticulously for spelling, grammar, and punctuation errors. A polished and professional letter will make a positive impression on the creditor.

Addressing Potential Objections

While a well-written letter can increase your chances of success, it’s important to be prepared for possible objections from creditors. Here are some common objections and how to address them:

- “There is no guarantee that the late payment will be removed.”

Acknowledge their point but emphasize your commitment to resolving the situation and making timely payments in the future. You can also offer a compromise, such as agreeing to a payment plan or providing additional documentation.

- “The late payment was not due to COVID-19.”

If your late payment occurred before the pandemic, be transparent about your financial situation and emphasize any positive changes you have made since then. Focus on your current financial stability and your commitment to staying on track.

- “You have already received a hardship program or similar assistance.”

Clarify that the hardship programs did not cover the late payment in question or that you are seeking the removal for other reasons, such as maintaining a strong credit score for future financing.

Staying Persistent and Professional

Even if your initial request is denied, don’t give up! Be persistent in your efforts to resolve the issue:

- Follow up with a phone call: After sending the letter, follow up with a phone call to the creditor to discuss your request. Be polite, professional, and reiterate your commitment to resolving the issue.

- Consider mediation: If you are unable to reach a resolution on your own, consider contacting a credit counseling agency or a dispute resolution service for professional guidance.

- File a dispute with a credit reporting agency: If the creditor refuses to remove the late payment, file a dispute with the credit reporting agencies (Equifax, Experian, and TransUnion) to state your case. While this process can be lengthy, it’s a worthwhile option as it can correct inaccurate information on your credit report.

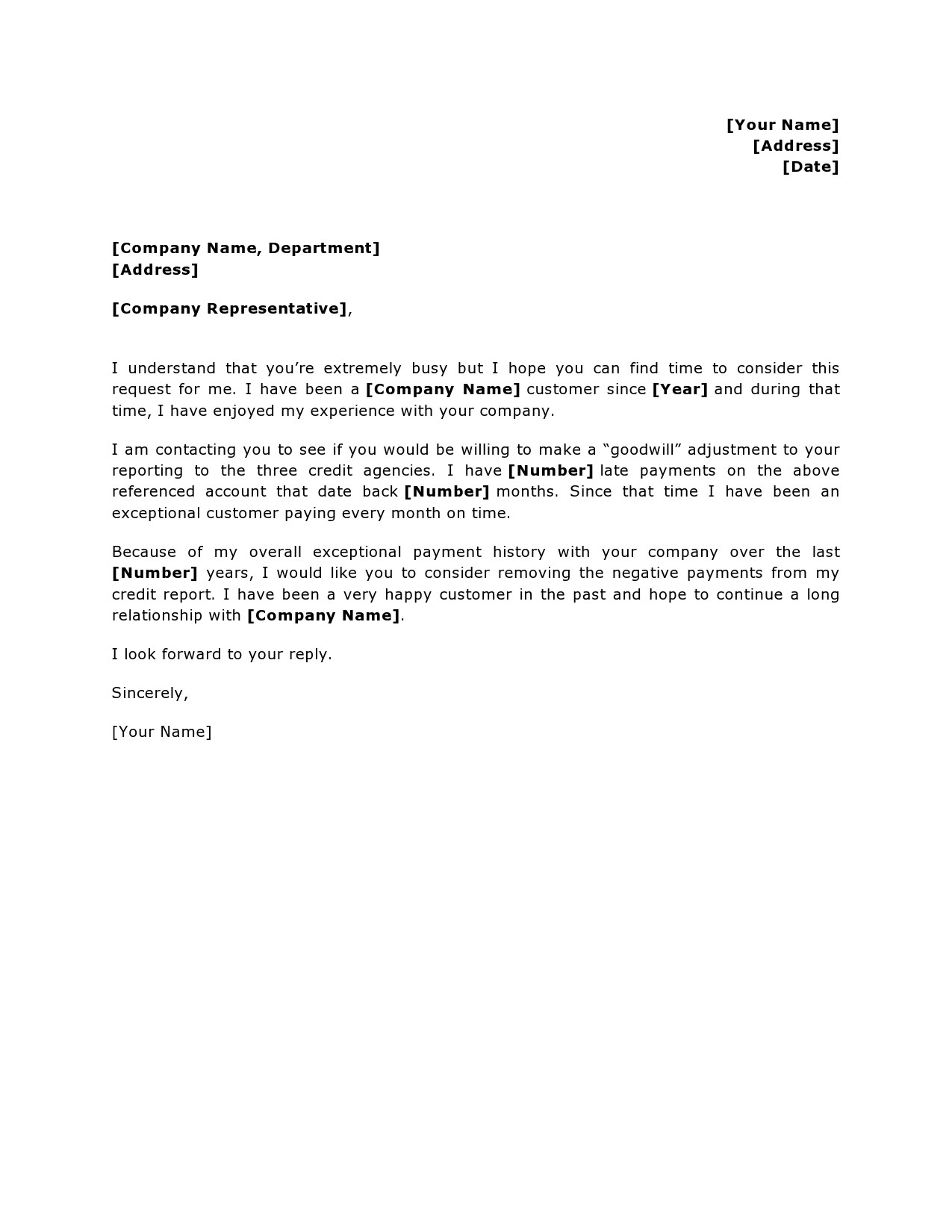

Late Payment Removal Letter Due To Covid-19 Template

Looking Ahead

Late payments can have a lasting impact on your credit score and your ability to access financing in the future. By understanding the power of late payment removal letters and crafting a compelling request, you can take proactive steps to mitigate the damage caused by late payments, particularly those resulting from the COVID-19 pandemic. Remember, persistence, professionalism, and a commitment to financial responsibility are vital in navigating the complexities of credit reporting and securing a healthy financial future.

This guide has provided you with the tools to advocate for yourself and potentially clear your credit report. If you remain unsure about the best approach, consulting with a credit counseling agency or financial advisor can provide valuable insights and personalized guidance.