Have you ever stumbled upon a dusty old bank statement tucked away in a drawer, a relic from a time when you were younger, perhaps fresh out of college or starting your first job? That forgotten account might be a treasure trove waiting to be rediscovered, but first, you’ll need to reactivate it.

Image: www.vrogue.co

Reactivating a dormant bank account can feel like navigating a bureaucratic maze, but it doesn’t have to be overwhelming. This comprehensive guide will provide you with a step-by-step process for reactivating your account, complete with sample letters and essential tips. Whether you’re looking to access forgotten funds, consolidate your finances, or simply reclaim a piece of your financial history, this guide will empower you to navigate the reactivation process with confidence.

Understanding Dormant Bank Accounts

A dormant bank account is essentially a sleeping giant. It’s an account that hasn’t seen any activity, like deposits or withdrawals, for a certain period, typically several months or even years. Banks may consider these accounts dormant to manage their resources and comply with regulations.

While your account may be dormant, it doesn’t mean it’s gone forever. It simply means it’s inactive. The good news is, you have the right to reactivate it and access your funds.

Steps to Reactivating Your Account

1. Contact Your Bank

The first step is to contact your bank. You can typically reach them via phone, email, or their website. Be prepared to provide your account details, including your account number, name, and any other information they might request for verification purposes.

Image: aspiringyouths.com

2. Understand the Requirements

Each bank has its own set of requirements for reactivation. Some banks might have simple procedures, while others might need you to visit a branch in person. Ask your bank about their policies, including any fees associated with reactivation.

3. Gather Necessary Documentation

Depending on the specific circumstances, you may need to provide certain documents for verification. The most common documents include:

- Government-issued identification (driver’s license, passport, etc.)

- Social Security card

- Proof of address (utility bill, bank statement with your name and address)

If you have any past statements or correspondence from the bank, keep them handy for reference. These documents will help expedite the reactivation process.

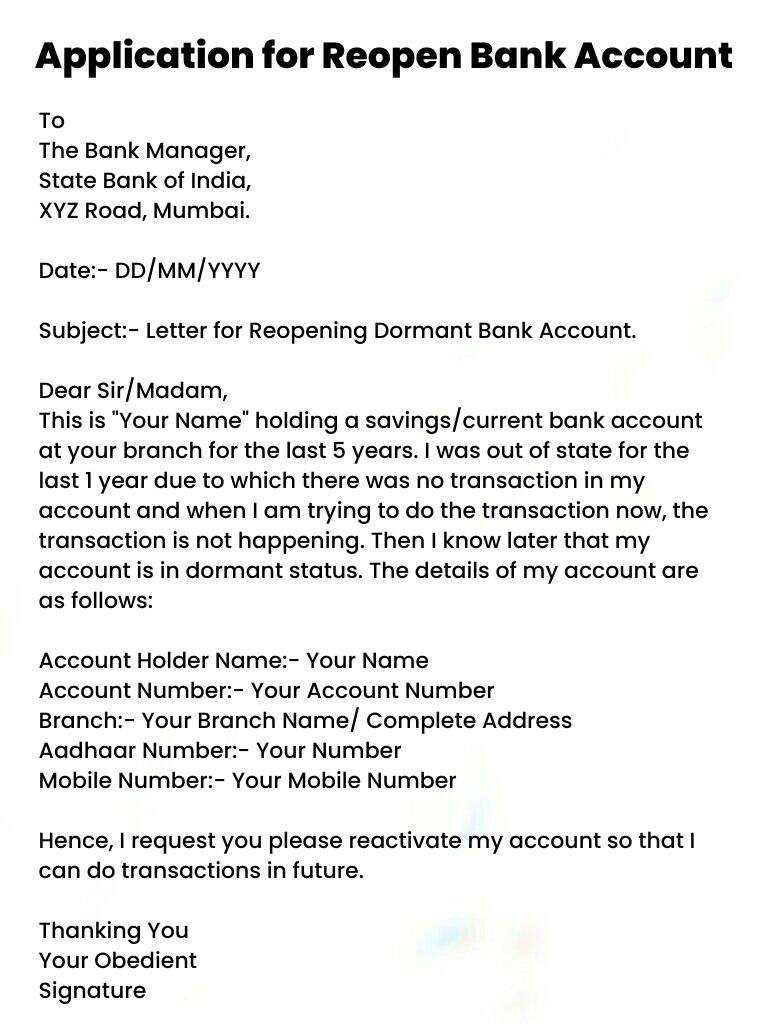

4. Submit a Written Request

Many banks require you to submit a written request for reactivation. This can be a formal letter stating your intention to reactivate the account, along with your details and account information.

Sample Bank Account Reactivation Letter

The following is a sample letter you can use to request reactivation:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Bank Name]

[Bank Address]

Subject: Reactivation of Account Number [Account Number]

Dear Sir/Madam,

I am writing to request reactivation of my bank account, account number [Account Number]. This account has been dormant for [Number of Years] years. I am now interested in accessing the funds in this account.

I would appreciate it if you could reactivate this account as soon as possible. I am available to provide any additional information or documentation necessary for the reactivation process.

Thank you for your time and assistance.

Sincerely,

[Your Signature]

[Your Typed Name]

Tips for Success

Here are some tips to make the reactivation process smoother:

- Be patient and persistent. Reactivating a dormant account may take some time. Follow up with your bank if you don’t receive a response within a reasonable timeframe.

- Clear any outstanding fees or charges. Before your account can be reactivated, you may need to clear any outstanding fees or charges. Make sure you understand all associated costs.

- Consider transferring your funds. Once your account is reactivated, you might want to transfer your funds to another account for greater convenience or access.

- Secure your account with updated security measures. Ensure you choose a secure password and enable two-factor authentication for added protection.

Beyond Reactivation: Maintaining Your Active Account

Reactivating a dormant account might be the first step in managing your finances more effectively. Here are some tips to keep your bank account active, organized, and secure:

- Stay updated on your account activity. Make a habit of regularly reviewing your bank statements and transaction history. This helps you catch any errors or unauthorized activities quickly.

- Set up alerts and notifications. Many banks offer alerts and notifications by text message, email, or app. These notifications can alert you to low balances, pending transactions, and other important account information.

- Consider online banking and mobile apps. Online banking and mobile apps provide convenient and secure access to your account. You can check your balance, transfer funds, and make payments all from your computer or smartphone.

- Protect your personal information. Be cautious about sharing your sensitive information, such as your account number or PIN, online. Always verify the authenticity of websites or emails you receive before sharing personal data.

The Importance of Financial Wellness

Reactivating a dormant bank account is just one small step in achieving financial wellness. By taking a proactive approach to your finances, you can gain control and make informed decisions about your money. This includes:

- Track your spending. Monitor your expenses and identify areas where you can save.

- Create a budget. A budget helps you plan your spending and ensures that you have enough money for your needs and wants.

- Save for the future. Establish a savings plan to reach your financial goals, whether it’s for a down payment, retirement, or your children’s education.

- Consider seeking professional advice. If you need help managing your finances, consider consulting a certified financial planner or other financial professional.

Bank Account Reactivation Letter Sample Pdf

Conclusion

Reactivating a dormant bank account can be a rewarding experience. It’s an opportunity to reclaim forgotten funds, consolidate your finances, and rediscover a piece of your financial history. While the process might require some effort, following the steps outlined in this guide and remaining patient with your bank can help you navigate the process smoothly. Remember, proactive financial management is a journey, and taking small steps like reactivating a dormant account can contribute to your overall financial well-being.