Imagine this: you’re finally ready to buy your dream home. You’ve saved diligently, painstakingly built a strong credit score, and are brimming with excitement. But then, a hidden roadblock emerges: hard inquiries on your credit report. These inquiries, often from lenders who pulled your credit for loan applications, can drag your score down, jeopardizing your chances of securing the mortgage you need.

Image: old.sermitsiaq.ag

This isn’t just a hypothetical scenario; it’s a reality for many people. Hard inquiries can seriously impact your financial wellbeing, and understanding how to deal with them is crucial for maintaining good credit. Today, we’ll equip you with the knowledge and tools necessary to address these inquiries, empowering you to take control of your credit and achieve your financial goals.

Understanding Hard Inquiries and Their Impact

Hard inquiries, also known as credit inquiries, are records on your credit report that indicate a lender or company has accessed your credit history to make a lending decision. These inquiries remain on your report for two years and can lower your score by a few points. While a single hard inquiry may not seem like a big deal, multiple inquiries within a short period can significantly damage your creditworthiness. For a lender, multiple hard inquiries often suggest financial instability or a tendency to overextend yourself, making you a riskier borrower.

The Unfair Reality of Hard Inquiries: A Tale of Two Borrowers

Let’s consider two individuals, both with excellent credit scores and financial histories. John has been carefully managing his finances for years and has a score of 780, while Sarah boasts a score of 800. Both individuals decide to seek pre-approval for a mortgage, hoping to secure a great interest rate. They visit several lenders, each pulling their credit history, resulting in multiple hard inquiries.

Now, imagine John and Sarah are applying for a mortgage simultaneously. Even though both individuals have excellent financial standing, John’s multiple hard inquiries might lead to a slightly higher interest rate compared to Sarah, even if his credit score is only marginally lower. This disparity highlights the unfair nature of hard inquiries, where seemingly minor differences can have a significant impact on your financial success.

Challenging Unfair Inquiries: A Powerful Tool

Fortunately, the Consumer Financial Protection Bureau (CFPB) recognizes the negative impact of hard inquiries on individuals’ credit scores. The CFPB has established guidelines for credit reporting agencies, allowing individuals to challenge inaccurate or unfair information, including hard inquiries.

Image: templates.rjuuc.edu.np

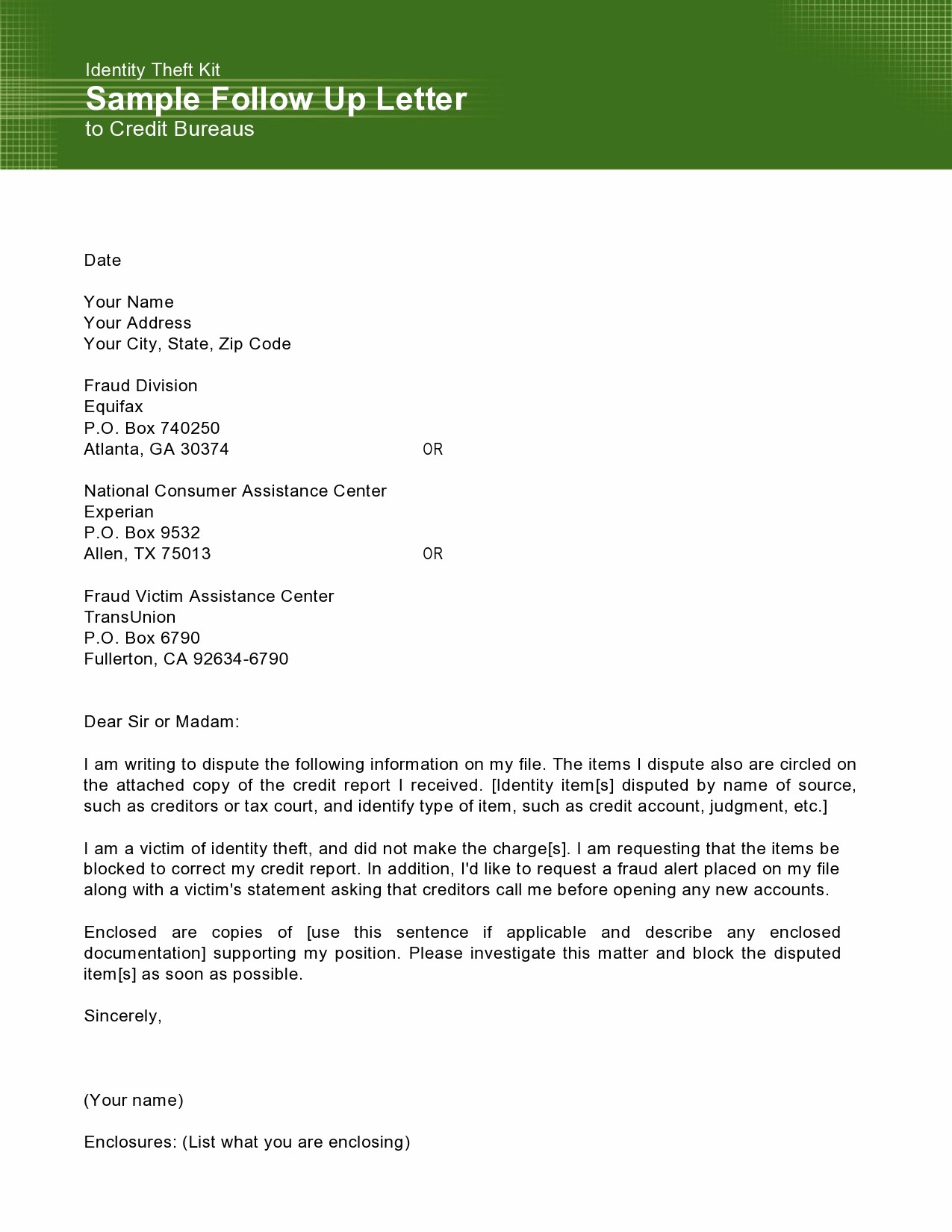

Crafting a Winning Letter: The Art of Persuasion

You can challenge a hard inquiry by sending a written dispute letter to the credit reporting agency. This letter should clearly explain why you believe the inquiry is inaccurate or unjust, supported by evidence and logical arguments.

Here’s a sample letter you can use as a starting point:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Credit Reporting Agency Name (e.g., Experian, Equifax, TransUnion)]

[Address of the Credit Reporting Agency]

Re: Dispute of Hard Inquiry Account Number [Account Number]

Dear [Name of Credit Reporting Agency],

This letter is to formally dispute a hard inquiry appearing on my credit report. The inquiry, listed under account number [Account Number], was generated by [Name of Company Making the Inquiry]. I believe this inquiry is unjust and negatively impacting my credit score.

[Explain your reasoning for disputing the inquiry. Here are some examples:]

- Inquiry not related to a loan application: You might have had a credit check for pre-approval but didn’t proceed with the loan or received an offer but declined it.

- Inquiry for a product you never applied for: A company might have incorrectly listed your name on an application, resulting in a hard inquiry.

- Multiple inquiries from the same lender: A single lender should only make one hard inquiry within a short period. Multiple inquiries may indicate an error or a deliberate attempt to negatively impact your credit.

[Provide supporting evidence. Examples include:]

- Copies of your credit report showing the inquiry in question.

- Communication with the lender confirming a pre-approval or denied loan application.

- Copies of loan documents if applicable.

[State your desired outcome:]

I request you to investigate this inquiry and remove it from my credit report if it is found to be inaccurate or unjustified. I would appreciate it if you could update my credit report to reflect the correction within [Reasonable timeframe, e.g., 30 days] and send me confirmation of any changes.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

The Power of Persuasive Language: Crafting a Compelling Case

When writing your dispute letter, remember to be polite yet firm. Articulate your arguments logically and use persuasive language to strengthen your case.

Example phrases:

- “I am requesting an immediate review of this hard inquiry.”

- “This hard inquiry is not only inaccurate but also extremely detrimental to my credit score.”

- “I have carefully reviewed my credit report and am confident that this inquiry is unjustified.”

- “I trust that you will take the necessary steps to remove this inaccurate information from my credit report.”

Seek Expert Help: Navigating the Credit Reporting Process

While the dispute letter is a powerful tool, it’s important to remember that you are not alone in this process. Consulting with a credit repair agency can provide valuable assistance in navigating the complexities of challenging hard inquiries. These agencies specialize in disputing inaccuracies on credit reports and can guide you through the process, ensuring your rights are upheld.

Securing Your Credit: Avoiding Unnecessary Inquiries

Preventing hard inquiries is essential for maintaining a strong credit score. Here are some effective strategies you can employ:

- Check your credit reports regularly: The three major credit reporting agencies (Experian, Equifax, and TransUnion) offer free access to your credit reports through AnnualCreditReport.com. Regularly reviewing your reports allows you to identify and dispute any unauthorized inquiries promptly.

- Limit pre-approval applications: Be selective when applying for pre-approvals. Often, you can get an idea of the interest rates you qualify for without formally applying for credit.

- Be cautious about sharing your social security number: Scammers may use this information to apply for credit in your name.

- Request a “soft inquiry” for credit scoring: Some companies offer credit monitoring services that require a soft inquiry, which doesn’t affect your score.

- Be informed about credit-reporting policies: Understand the Credit Reporting Act and learn how credit reporting agencies should handle your personal credit data.

Sample Letter To Remove Hard Inquiries

Embracing Financial Empowerment: Taking Action

Challenging hard inquiries can seem daunting, but it’s essential to remember that you have a right to accurate and fair credit reporting. By understanding your credit report, disputing inaccurate information, and employing preventive measures, you can reclaim control of your finances and achieve your financial goals. Remember, your credit score is a reflection of your financial responsibility, and taking proactive steps to protect it can lead to a brighter financial future.

Embrace your financial empowerment and take action today!