Have you ever found yourself fumbling through numerous emails and online banking portals just to get a clear picture of your finances? Imagine having a readily accessible, organized record of your transactions, allowing you to easily track your spending, budget accurately, and manage your accounts with ease. This is precisely what a reliable bank statement template offers, and for Bank of America customers, getting a personalized template can be a game-changer.

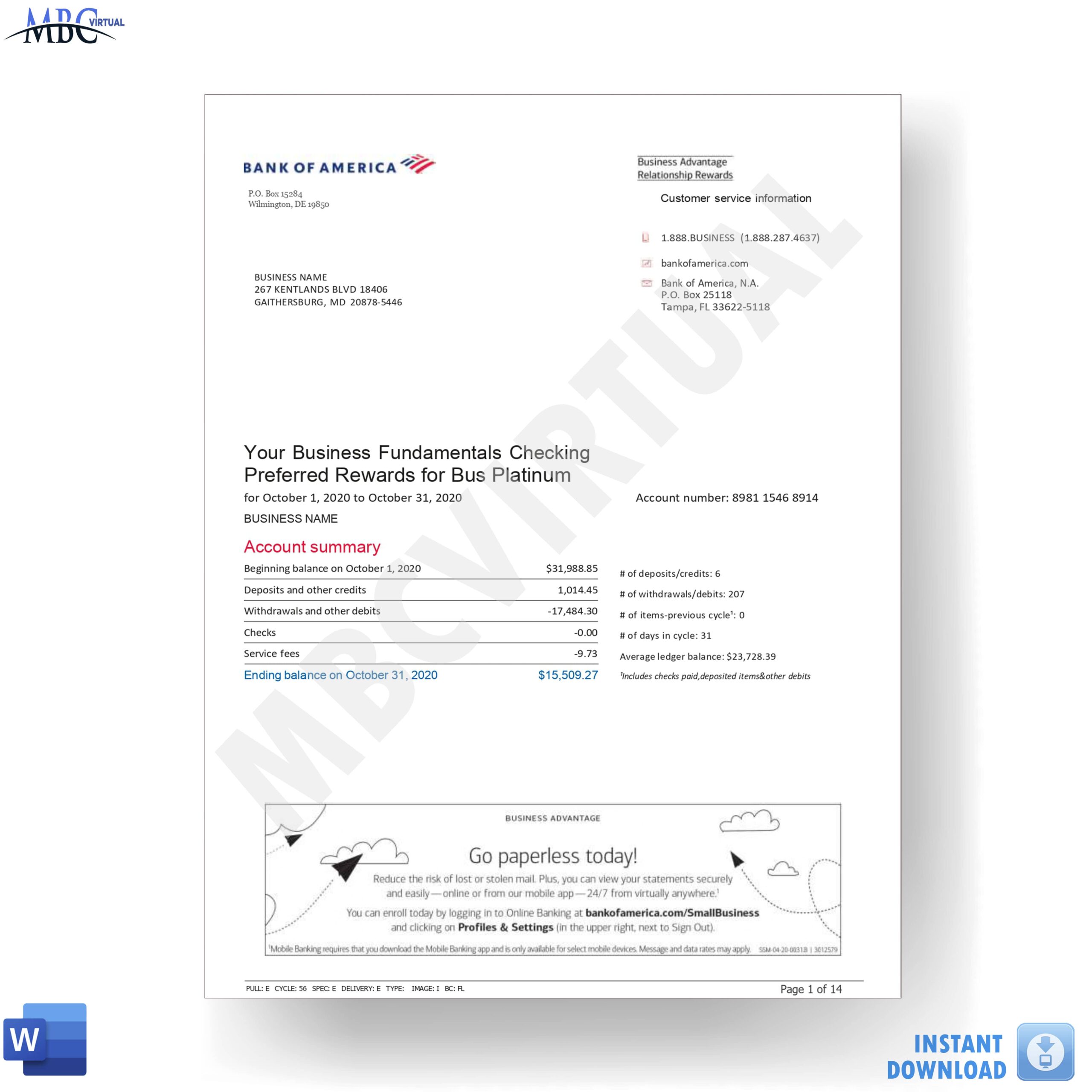

Image: mbcvirtual.com

While most banks provide online statements, having a downloadable template empowers you to take ownership of your financial data, making it easier to track progress, analyze spending trends, and make informed financial decisions. This guide will delve into the intricacies of Bank of America’s bank statement templates, explaining their benefits, how to access them, and ways to use them effectively.

Understanding Bank of America Bank Statement Templates

Bank of America bank statement templates are customizable documents that mirror the format of official Bank of America statements. They allow you to create a structured record of your banking transactions, including deposits, withdrawals, payments, and other financial activities. These templates can be downloaded from the Bank of America website or via third-party financial management tools, providing users with a flexible and adaptable option to manage their finances.

Key Features and Benefits

Using a Bank of America bank statement template offers a plethora of benefits, making it a valuable resource for individuals looking to maximize their financial control. Here are some key advantages:

1. Enhanced Organization and Clarity

By using a template, you can consolidate all your banking information into a structured document. This eliminates the need to sift through countless emails or online documents, ensuring a clear and concise overview of your financial activity.

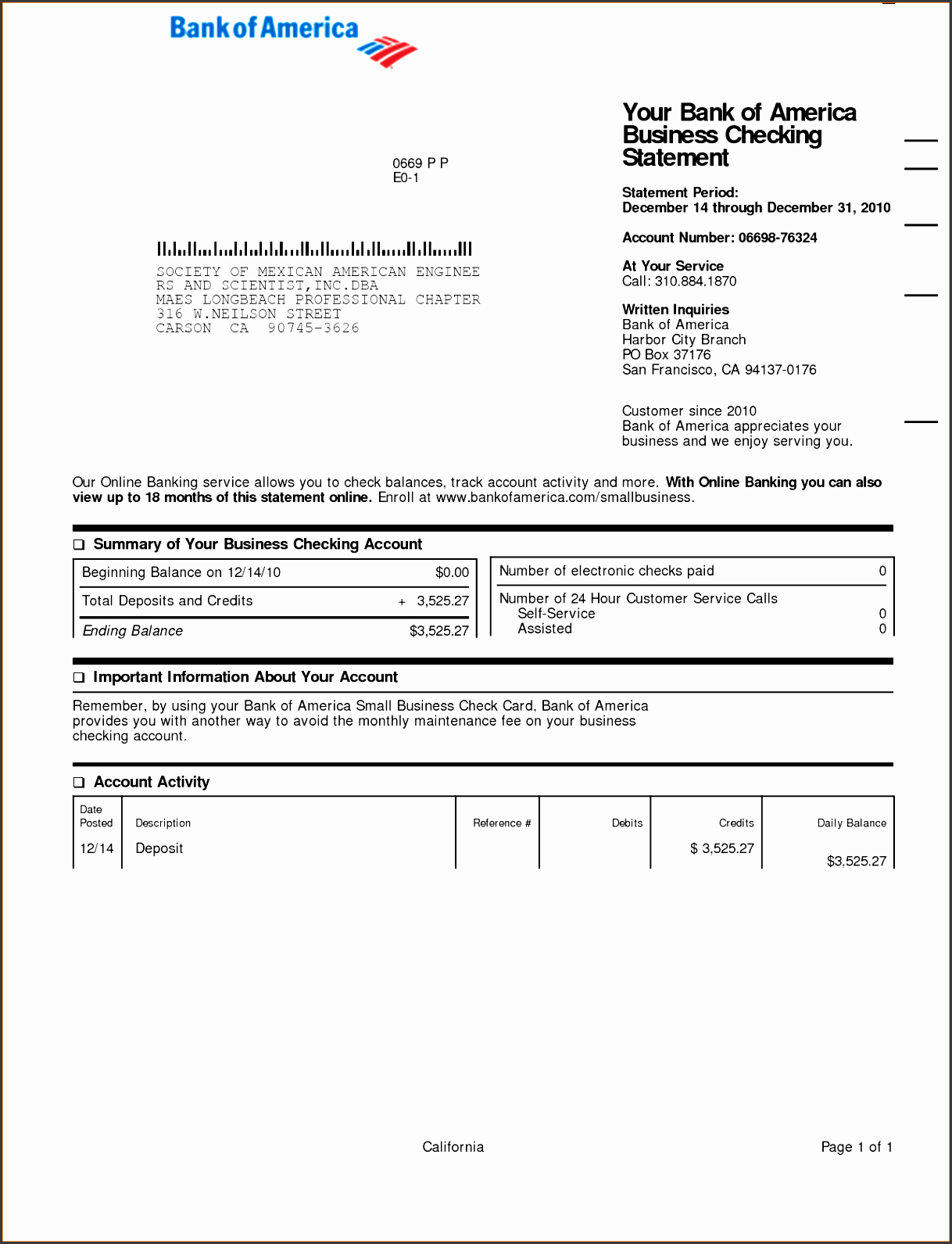

Image: templates.rjuuc.edu.np

2. Streamlined Budget Management

Bank statement templates serve as a visual representation of your income and expenses, making budgeting a breeze. Categorize transactions, track spending patterns, and identify areas where you can optimize your budget efficiently.

3. Easy Reconciliation

Reconciling your bank transactions against your physical records becomes effortless with a template. Cross-reference entries and easily spot any discrepancies, ensuring accuracy and preventing potential financial oversights.

4. Financial Analysis and Tracking

Templates offer the flexibility to track your financial progress over time. Analyze spending trends, identify areas of improvement, and make informed financial decisions based on a clear view of your financial history.

5. Printable and Exportable

Bank of America templates are available in printable and exportable formats, making it easy to share your financial information with others, such as tax preparers, financial advisors, or even yourself for easy reference on the go.

Accessing and Using Bank of America Bank Statement Templates

You can access Bank of America bank statement templates in a variety of ways, depending on your needs and preferences:

1. Download from Bank of America Website

Bank of America provides a downloadable bank statement template directly on its website. This template is designed to align with the bank’s official statement format, ensuring compatibility and consistency.

2. Utilize Third-Party Financial Management Platforms

Numerous financial management tools like Mint, Personal Capital, and YNAB offer customizable bank statement templates that integrate seamlessly with your Bank of America account. These platforms provide added features for budgeting, tracking, and financial analysis.

3. Create Your Own Template

For those seeking complete customization, you can create a personalized bank statement template using spreadsheet software like Microsoft Excel or Google Sheets. This allows you to design a template that aligns perfectly with your specific financial management needs.

Tips for Effective Template Utilization

To effectively leverage a Bank of America bank statement template, consider these tips:

1. Categorize Transactions

Categorizing transactions into meaningful groups (e.g., groceries, entertainment, utilities) provides valuable insights into your spending patterns, enabling you to identify areas where you can allocate your budget more efficiently.

2. Track Recurring Expenses

Identify recurring expenses such as rent, utilities, and loan payments. Monitor these costs to ensure they remain within your budget and to anticipate any potential fluctuations.

3. Set Financial Goals

Use the template to track your progress towards specific financial goals, whether it’s saving for a down payment, paying off debt, or building an emergency fund. Regular monitoring helps you stay motivated and on track.

4. Analyze Spending Trends

Review your past statements to identify spending trends and make informed decisions about your financial habits. For example, if you consistently overspend on dining out, consider reducing restaurant visits or opting for more affordable alternatives.

5. Reconcile Regularly

Regularly reconcile your bank statements against your physical records, ensuring accuracy and preventing financial discrepancies. This proactive approach safeguards your finances and minimizes the risk of errors.

FAQs

Here are some frequently asked questions about Bank of America bank statement templates:

Q: Can I use a template for multiple bank accounts?

A: Yes, you can use a single template to track multiple bank accounts, making it easier to manage your finances across different accounts in one centralized location.

Q: Are there any security concerns associated with using templates?

A: Bank of America templates available through the official website are secure. Be cautious about downloading templates from unknown or untrusted sources to avoid potential security risks.

Q: How often should I update my template?

A: Updating your template regularly with current bank statements allows you to maintain accurate and up-to-date financial records.

Q: Can I personalize the template further?

A: Yes, you can customize the template to fit your specific needs and preferences. Add columns, change formatting, and modify the layout to tailor it to your requirements.

Bank Of America Bank Statement Template

Conclusion

Mastering your finances starts with clear financial transparency, and Bank of America bank statement templates offer an effective solution to achieve this goal. These templates provide a structured method to track your banking activity, analyze spending patterns, and make informed financial decisions. Whether downloaded from the Bank of America website, utilized through third-party financial management tools, or customized to your liking, these templates empower you to take control of your finances and embark on a journey toward financial stability and success.

Are you interested in using Bank of America bank statement templates to streamline your financial management? Share your thoughts and experiences in the comments below.