Imagine this: you’re sitting down to pay your bills, and suddenly, a wave of confusion washes over you. You’re staring at your Bank of America statement, but it’s like deciphering a foreign language. You see numbers, dates, and cryptic descriptions, but the real story behind your finances remains shrouded in mystery. Don’t worry, you’re not alone. Many people struggle to fully understand the details hidden within their bank statements. But fear not! This comprehensive guide will equip you with the knowledge and tools to decipher your Bank of America statement and gain complete control over your financial destiny.

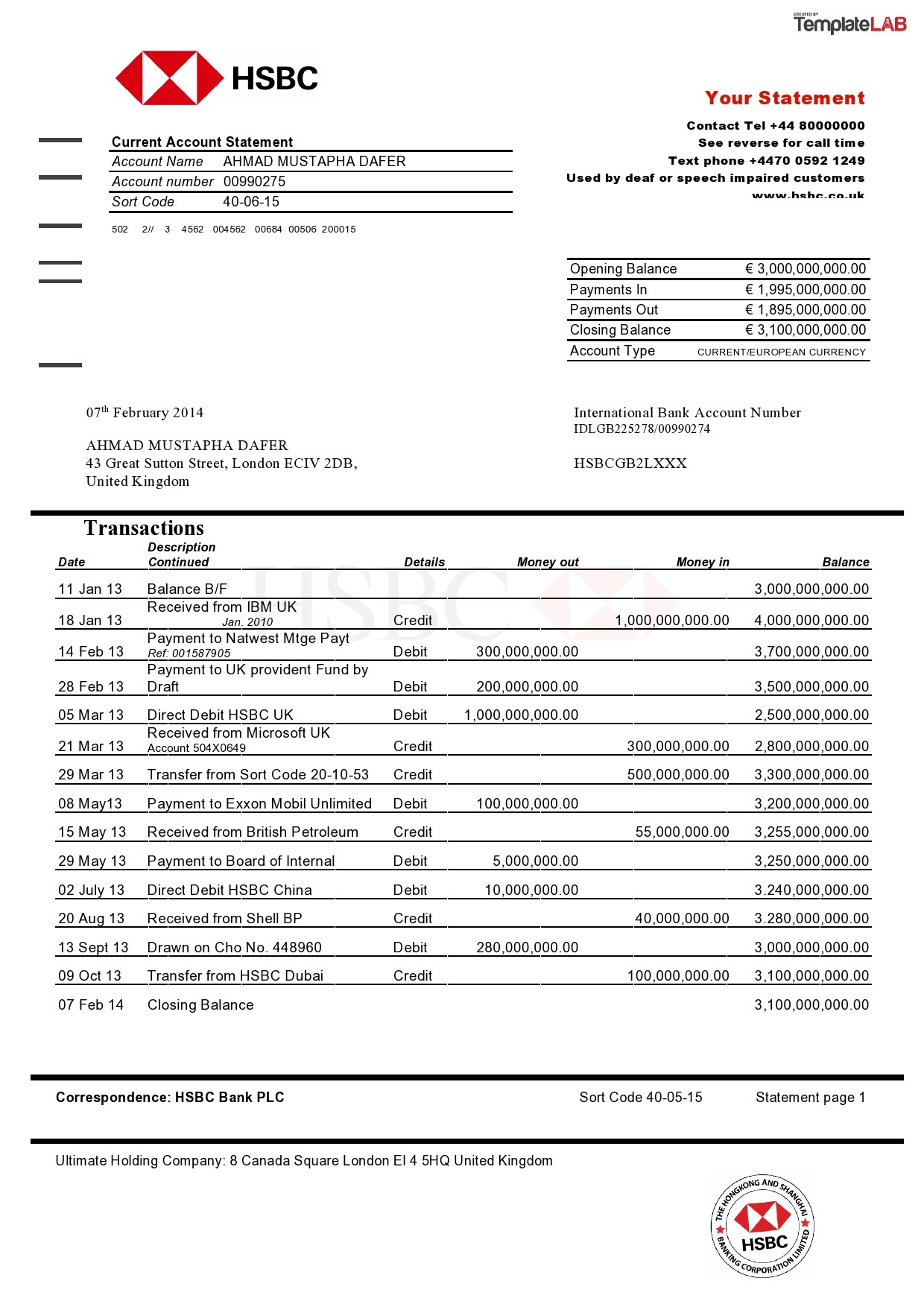

Image: templatelab.com

Navigating your finances can feel overwhelming, but your Bank of America statement holds the key to unlocking clarity. It’s more than just a collection of numbers; it’s a window into your spending habits, a roadmap to your financial goals, and a powerful tool for managing your money wisely. This guide will delve into the intricacies of your Bank of America statement, breaking down its key components, revealing hidden insights, and providing actionable tips for maximizing your financial well-being.

Unveiling the Layers of Your Bank of America Statement

Your Bank of America statement acts as a comprehensive record of your financial transactions, meticulously documenting every deposit, withdrawal, and fee associated with your account. It’s a powerful tool for understanding your financial activity, but only if you understand how to read it.

The Statement Header: Your Account at a Glance

The statement header provides a concise overview of your account information, acting as the first step in deciphering its contents. This section includes:

- Account Number: A unique identifier that distinguishes your account from others.

- Statement Period: The timeframe covered by the statement, allowing you to track your activity over a specific time period.

- Account Type: Clearly designates whether your account is a checking, savings, or credit card.

- Account Balance: The exact amount of money currently available in your account.

Transaction History: A Chronicle of Your Financial Activity

The heart of your statement lies in the transaction history section, which chronicles your financial activity during the statement period. Each transaction is listed in detail, revealing:

- Date: The date of the transaction, providing a timeline for your financial activity.

- Description: A brief description of the transaction; this could include the name of the merchant, payee, or service.

- Debit/Credit: Designates whether funds were withdrawn (debit) or deposited (credit) into your account.

- Amount: The monetary value of the transaction, reflecting the amount of money that was added or removed.

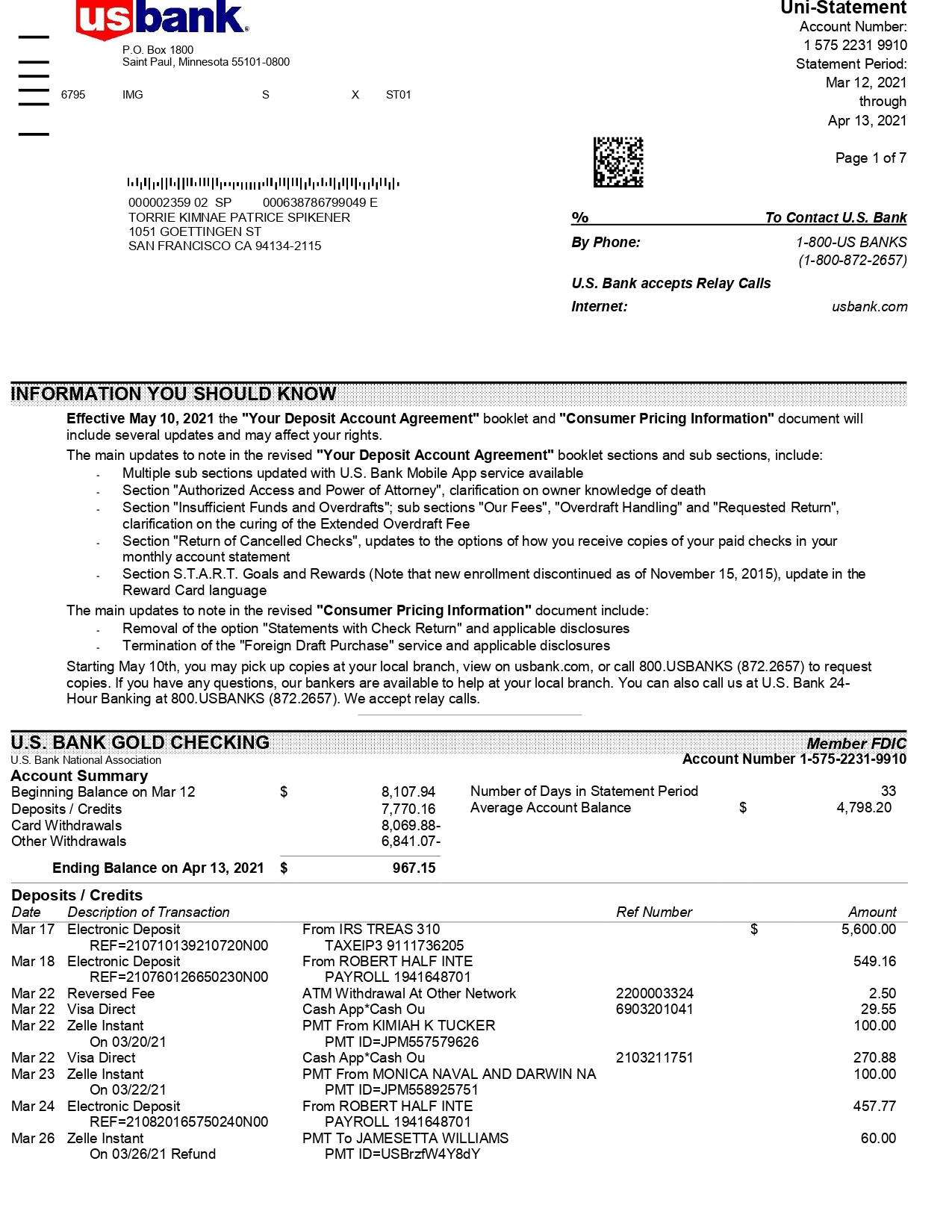

Image: mbcvirtual.com

Fee Details: Uncovering Hidden Costs

Fee details are often buried within the statement, but they are critical to understanding the true cost of your banking relationship.

- Monthly Maintenance Fees: These fees are levied for maintaining your bank account, and are often determined by the type and balance of your account.

- Overdraft Fees: Penalties for withdrawing more money than is available in your account.

- ATM Fees: Charges incurred for using ATMs outside of Bank of America’s network.

Account Summary: A Snapshot of Your Financial Health

The summary section acts as a concise overview of your account activity, highlighting key financial metrics:

- Beginning Balance: The starting balance of your account at the beginning of the statement period.

- Total Deposits: The sum of all deposits made during the statement period.

- Total Withdrawals: The sum of all withdrawals made during the statement period.

- Ending Balance: The final balance of your account at the end of the statement period.

Beyond the Numbers: Unveiling Insights from Your Statement

Your Bank of America statement isn’t just a dry record of transactions; it’s a rich source of insights into your financial habits. By analyzing your spending patterns, you can identify areas for improvement and optimize your financial health.

Identifying Spending Trends: Where Does Your Money Go?

By carefully examining the transaction history, you can identify recurring spending patterns and gain valuable insights into your financial behavior.

- Categorize Expenses: Group your transactions by category (groceries, dining, entertainment, etc.) to understand how much you spend in each area.

- Track Recurring Expenses: Identify subscription services, bills, and other recurring charges to ensure they are still necessary and within your budget.

- Spot Unexpected Spending: Unusual transactions can often highlight unexpected or unnecessary expenses, allowing you to take corrective action.

Assessing Overall Financial Health: Are You on Track?

Your bank statement can act as a gauge of your overall financial well-being, providing valuable insights into your financial health.

- Compare Statements: Compare your current statement to previous ones to identify trends in spending and savings patterns.

- Reflect on Your Goals: Use your statement to assess your progress toward your financial goals (paying down debt, building savings, investing) and make necessary adjustments.

- Seek Professional Guidance: If your statement reveals concerning spending patterns or financial challenges, don’t hesitate to seek advice from a financial advisor or credit counselor.

Take Control: Actionable Tips for Financial Success

Your Bank of America statement is a tool for financial empowerment, but only if you know how to use it. By implementing these actionable tips, you can harness the power of your statement to achieve your financial goals.

- Set a Budget: Use your statement to create a budget that aligns with your financial priorities.

- Track Your Expenses: Regularly monitor your spending to ensure you remain within your budget.

- Automate Savings: Utilize Bank of America’s automatic savings features to build a strong financial foundation.

- Review Your Fees: Periodically review your statement for unnecessary fees and consider switching to a more affordable banking option.

- Seek Financial Education: Embark on a journey of financial education through reputable resources like Bank of America’s online financial tools.

Bank Statement Template Bank Of America

Conclusion: A Journey of Financial Knowledge

Navigating the complexities of your Bank of America statement may seem daunting, but it’s a crucial step towards financial empowerment. By understanding its components, uncovering hidden insights, and implementing actionable strategies, you can unlock the secrets of your finances and embark on a journey towards financial success. Remember, your statement is a valuable tool – use it wisely, and it will guide you towards a brighter financial future.