In today’s dynamic and interconnected world, businesses of all sizes face a constant barrage of risks, from cyberattacks and natural disasters to market fluctuations and reputational damage. Effective risk management is no longer a luxury, but a necessity for survival and growth. But who is responsible for this critical function, and what exactly are their roles and responsibilities? This guide delves into the multifaceted world of risk management and provides a comprehensive overview of the key roles, responsibilities, and processes involved.

Image: www.pnb.com.ph

The importance of risk management stems from its ability to protect an organization’s assets, preserve its reputation, and ensure its long-term sustainability. By proactively identifying, assessing, and mitigating potential threats, risk managers safeguard against unforeseen circumstances and help organizations navigate uncertainty with confidence. Downloading this PDF will equip you with the knowledge and tools to effectively implement a comprehensive risk management framework within your organization.

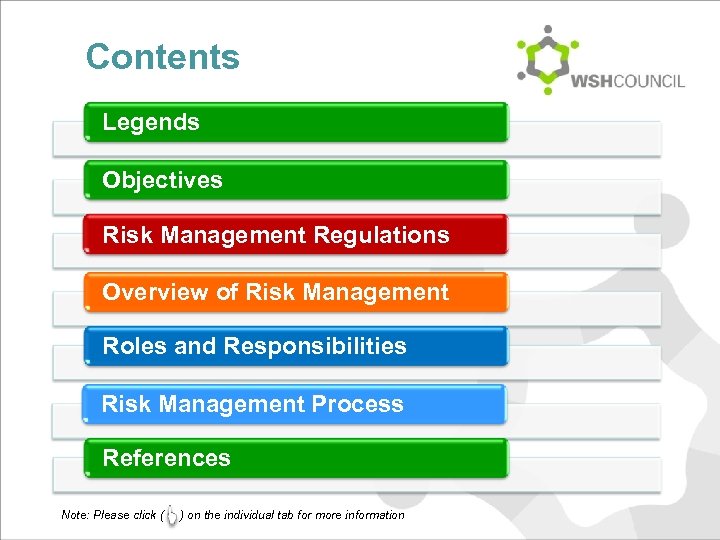

Defining Risk Management and Its Core Components

Risk management is a systematic process that organizations use to identify, analyze, and manage potential threats and uncertainties that could impact their operations, financial performance, and overall success. It involves a structured approach to evaluating risks, developing strategies to mitigate them, and monitoring their effectiveness over time.

Key Components of Risk Management:

- Risk Identification: The process of systematically identifying potential risks that could affect the organization.

- Risk Assessment: Evaluating the likelihood and impact of each identified risk to determine its severity.

- Risk Response: Developing strategies to address each risk, such as avoiding, mitigating, transferring, or accepting the risk.

- Risk Monitoring and Control: Continuously tracking and monitoring the effectiveness of risk mitigation strategies and making adjustments as needed.

Risk Management Roles and Responsibilities

Successful risk management requires a collaborative effort across different levels and departments within an organization. Here are some of the key roles and their corresponding responsibilities:

Image: present5.com

1. Chief Risk Officer (CRO)

The CRO is responsible for overseeing the organization’s overall risk management framework and ensuring its effective implementation. They typically report directly to the CEO or board of directors and have a broad perspective on the organization’s risk profile.

Key Responsibilities:

- Developing and maintaining the organization’s risk management framework.

- Establishing risk appetite and tolerance levels.

- Leading the risk management process and providing guidance to other departments.

- Reporting on risk management activities to senior management and the board.

- Championing a risk-aware culture across the organization.

2. Risk Management Team

The risk management team is a group of professionals responsible for implementing and managing the organization’s risk management framework. They work closely with the CRO and other departments to identify, analyze, and mitigate risks.

Key Responsibilities:

- Conducting risk assessments and developing risk mitigation strategies.

- Monitoring risk events and reporting on their impact.

- Facilitating risk discussions and workshops with stakeholders.

- Keeping abreast of industry best practices and emerging risks.

3. Business Unit Managers

Business unit managers are responsible for managing the risks associated with their specific areas of responsibility. They work with the risk management team to implement risk mitigation strategies and ensure that risk considerations are integrated into their decision-making processes.

Key Responsibilities:

- Identifying and assessing risks within their business unit.

- Developing and implementing risk mitigation plans.

- Monitoring risk events and reporting to the risk management team.

- Collaborating with the risk management team to ensure alignment with the organization’s overall risk management framework.

4. Employees

All employees have a role to play in risk management. They are expected to be aware of and comply with the organization’s risk management policies and procedures. They should also report any potential risks or incidents they observe.

Key Responsibilities:

- Understanding the organization’s risk management framework and its relevance to their roles.

- Following established risk management policies and procedures.

- Reporting any potential risks or incidents to the appropriate personnel.

- Participating in risk management training and awareness programs.

Benefits of Effective Risk Management

Implementing a strong risk management framework yields a multitude of benefits for organizations, including:

- Reduced Losses: Proactive identification and mitigation of risks minimizes financial and reputational losses.

- Improved Decision-Making: Risk awareness enables better informed and more strategic decisions.

- Enhanced Regulatory Compliance: Meeting regulatory requirements and minimizing the risk of legal penalties.

- Increased Efficiency: Efficient risk management processes streamline operations and improve productivity.

- Improved Reputation: Demonstrating a commitment to risk management enhances stakeholder trust and confidence.

- Enhanced Resilience: Organizations become more prepared to handle unexpected events and disruptions.

Risk Management Frameworks and Standards

Organizations can leverage various frameworks and standards to guide their risk management process. Some widely recognized frameworks include:

- COSO Enterprise Risk Management Framework: A comprehensive framework developed by the Committee of Sponsoring Organizations of the Treadway Commission, providing a structured approach to risk management.

- ISO 31000: Risk Management – Guidelines: An international standard offering general guidance on risk management principles and practices.

- NIST Cybersecurity Framework (CSF): A framework developed by the National Institute of Standards and Technology (NIST) to help organizations manage cybersecurity risks.

Key Risks in Different Industries

Risk management challenges vary across different industries. Here are a few examples of common risks in specific sectors:

Financial Services

- Market risk

- Credit risk

- Operational risk

- Cybersecurity risk

- Regulatory risk

Healthcare

- Patient safety risk

- Cybersecurity risk

- Compliance risk

- Reputational risk

- Financial risk

Manufacturing

- Operational risk

- Safety risk

- Environmental risk

- Supply chain risk

- Quality risk

Emerging Trends in Risk Management

The risk management landscape is constantly evolving. Some emerging trends include:

- Increased Focus on Cyber Risk: The growing prevalence of cyberattacks has led to a heightened emphasis on cybersecurity risk management.

- Integrating Technology: Organizations are increasingly leveraging data analytics and artificial intelligence (AI) to improve risk assessment and mitigation processes.

- Emphasis on Culture: Building a risk-aware culture that encourages employees to identify and report potential risks is becoming crucial.

- Focus on Sustainability and ESG (Environmental, Social, and Governance) Factors: Organizations are increasingly incorporating ESG factors into their risk management strategies.

Risk Management Roles And Responsibilities Pdf

Conclusion

Effective risk management is a vital component of organizational success. By understanding the key roles and responsibilities, implementing robust frameworks, and adapting to emerging trends, organizations can mitigate potential threats, make informed decisions, and navigate uncertainty with confidence. Download this comprehensive guide and equip your team with the knowledge and tools to navigate the ever-changing risk landscape.