Dreaming of owning your own home? Many Filipinos are, and the Pag-IBIG Housing Loan Program is often the key to making that dream a reality. But with a loan process comes the daunting task of figuring out the numbers. How much will your monthly payments be? What are the hidden fees and costs? Don’t worry, we’re here to break it down and give you a clearer picture. This guide provides a detailed sample computation, helping you understand the ins and outs of Pag-IBIG’s housing loan program.

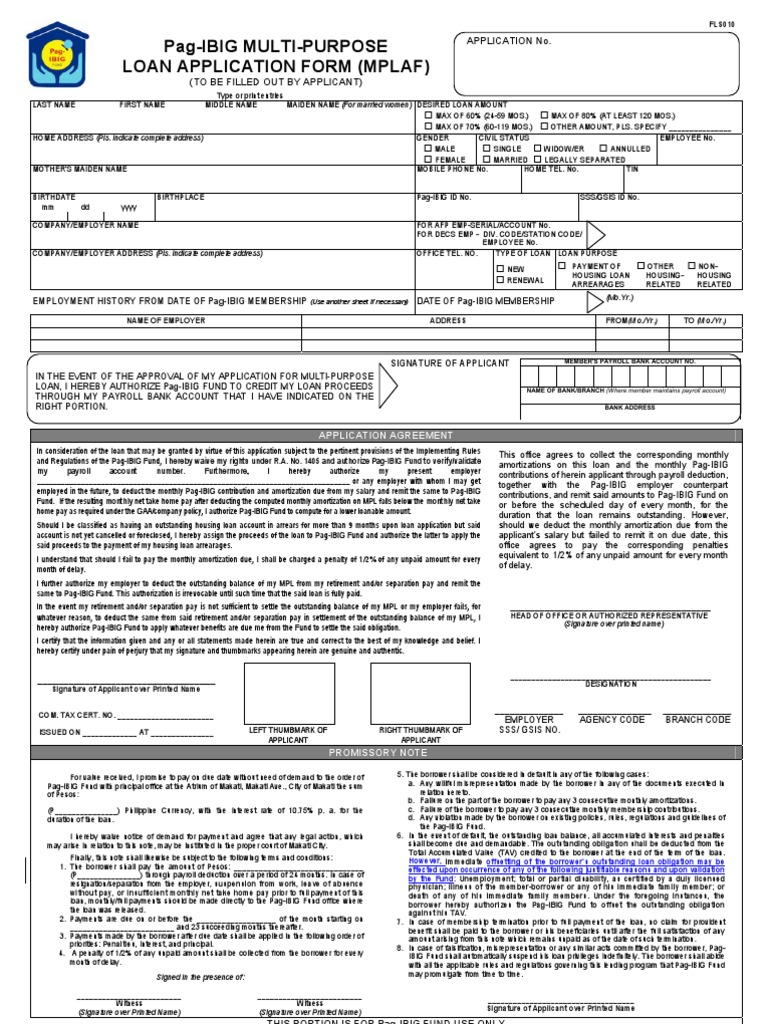

Image: www.scribd.com

Whether you’re a first-time homebuyer, looking to upgrade, or simply curious about how these loans work, this article is for you. We’ll cover everything from calculating the loan amount and interest to understanding the fees involved and exploring alternative scenarios. So grab your calculator, a cup of coffee, and let’s dive into the world of Pag-IBIG housing loans!

Understanding the Basics: What You Need to Know

Pag-IBIG Housing Loan Program: A Quick Overview

The Pag-IBIG Housing Loan program, designed to assist Filipinos in achieving homeownership, offers a range of loan options catering to diverse needs. This program is managed by the Home Development Mutual Fund (HDMF), a government-owned and controlled corporation that aims to provide affordable and accessible housing financing for its members.

Types of Pag-IBIG Housing Loans

There are several types of Pag-IBIG housing loans available, each with its own set of features and eligibility requirements. These include:

- Regular Housing Loan: This loan is suitable for purchasing new or pre-owned homes, townhouses, duplexes, or apartments. It offers competitive interest rates and flexible repayment terms.

- Home Improvement Loan: Designed for renovations, repairs, and home extensions. This loan allows you to enhance your living space and adapt your home to your changing needs.

- Lot Acquisition Loan: This option enables you to buy a lot for future home construction, providing a foundation for your dream home.

- Construction Loan: If you’ve already secured a lot, a construction loan can fund the building of your house according to your specifications.

Image: blognigigi.blogspot.com

Sample Pag-IBIG Housing Loan Computation

Scenario: Buying a New House

Let’s assume you’re interested in buying a new house worth PHP 3,000,000. You’ve been a Pag-IBIG member for several years, and you’re applying for a Regular Housing Loan. Here’s how we can calculate your estimated monthly payment using hypothetical figures:

1. Loan Amount

First, determine the loan amount you need. This is usually the difference between the total cost of the house and your own down payment, as Pag-IBIG loans require a minimum downpayment. Let’s say your down payment is PHP 600,000.

Loan Amount = Total House Cost – Down Payment

Loan Amount = PHP 3,000,000 – PHP 600,000 = PHP 2,400,000

2. Interest Rate

Pag-IBIG interest rates vary depending on the loan type, the loan amount, and current market conditions. To illustrate, we’ll use a hypothetical interest rate of 6% per annum.

3. Loan Term

Pag-IBIG offers loan terms ranging from 5 to 30 years, depending on your age and financial capacity. Let’s consider a loan term of 20 years (240 months).

4. Monthly Payment

To calculate the estimated monthly payment, you can use the following formula:

Monthly Payment = (Loan Amount x Interest Rate) / (1 – (1 + Interest Rate)^- Loan Term)

Monthly Payment = (PHP 2,400,000 x 0.06/12) / (1 – (1 + 0.06/12)^-240)

Monthly Payment = PHP 15,000

5. Additional Fees

Aside from monthly payments, Pag-IBIG loans have other associated fees, such as:

- Appraisal Fee: Charged for assessing the property’s value.

- Documentary Stamp Tax (DST): A tax based on the loan amount.

- Processing Fee: A fee for handling the loan application.

- Mortgage Registration Fee: Paid for registering the mortgage with the Land Registration Authority.

- Flood Insurance: Required for properties in flood-prone areas.

These fees can add up, so it’s essential to factor them into your overall budget. Make sure you consult the latest Pag-IBIG guidelines for the specific fees and their amounts.

Exploring Different Scenarios and Factors

The sample computation above serves as a guide, but it’s important to understand that your actual monthly payment and total loan cost will vary based on several factors:

1. Loan Amount

A larger loan amount will naturally lead to higher monthly payments. The more you borrow, the more you’ll have to repay over time. Try to minimize the loan amount by making a larger down payment or finding a property within your budget.

2. Interest Rate

As interest rates fluctuate, your monthly payment will change accordingly. Lower interest rates will result in lower payments, making it more affordable to repay the loan. Keep an eye on market trends and potential interest rate adjustments.

3. Loan Term

A longer loan term (more months) means lower monthly payments, but you’ll end up paying more interest overall. Shorter loan terms mean higher payments but less interest paid in the long run. Choose a term that aligns with your financial capacity and long-term plans.

4. Fixed vs. Variable Interest Rates

Pag-IBIG offers both fixed and variable interest rates. Fixed rates remain constant for the duration of your loan, offering predictable payments. Variable rates can fluctuate based on market conditions, leading to uncertainty in your monthly payments.

5. Prepayments and Early Loan Repayments

Pag-IBIG allows for prepayments, which can significantly reduce the total interest paid on your loan over time. The more you pay ahead of schedule, the quicker you’ll become debt-free.

Pag Ibig Housing Loan Sample Computation

Key Takeaways and Next Steps

Understanding the basics of Pag-IBIG housing loan computation gives you a solid foundation for making informed decisions about your homeownership journey. Remember, this is just a guide; it’s crucial to consult with Pag-IBIG directly for the most accurate and up-to-date information regarding interest rates, fees, and specific loan requirements.

Don’t hesitate to seek guidance from a financial advisor or Pag-IBIG representative. They can assess your financial situation, help you choose the right loan type, and guide you through the entire loan application process. With proper planning and careful consideration, you can turn your dream of owning a home into a reality!