Have you ever wondered why the economy seems to swing like a pendulum, alternating between periods of growth and decline? This rhythmic movement, known as the business cycle, is a fundamental concept in economics that impacts our lives in countless ways. From the price of groceries to the availability of jobs, the business cycle dictates the course of our economic fortunes. In this article, we’ll delve into the four distinct phases of the business cycle, explore their characteristics, and understand why they matter to us all.

Image: ivi-fertility.com

The business cycle refers to the cyclical upswing and downswing in broad measures of economic activity such as output, employment, and income. Understanding these fluctuations is crucial for businesses, investors, and policymakers alike. By recognizing the signs of each phase, we can anticipate trends, make more informed decisions, and mitigate potential risks.

The Four Phases of the Business Cycle

Imagine a roller coaster. It climbs high, then plunges down, and finally reaches its base before starting the exhilarating ride again. The business cycle works similarly, but instead of thrills, it offers economic growth and contraction. Let’s break down these four phases:

1. Expansion

The expansion phase is characterized by rising economic activity, higher production, and increased consumer spending. Businesses thrive, unemployment falls, and wages typically increase. This period feels like a positive feedback loop, with rising confidence leading to more investment and spending, further fueling the economic engine.

- Key indicators:

- Increasing GDP: The overall value of goods and services produced rises.

- Falling Unemployment: More people find jobs as businesses hire to meet increased demand.

- Rising Stock Prices: Businesses’ profitability rises, leading to higher stock valuations.

- Increased consumer confidence: People are more optimistic about the future and tend to spend more freely.

Real-world example: The period between 1990 and 2000 in the United States is often considered a period of strong economic expansion. The dot-com boom, fueled by technological advancements and innovation, drove significant economic growth, low unemployment, and a surge in stock valuations.

2. Peak

The peak represents the highest point in economic activity during the business cycle. This phase is often marked by tight labor markets, high inflation, and declining interest rates as the Federal Reserve tries to cool down the economy. This is the time when economic growth is most robust, but it also marks the beginning of the downturn.

- Key indicators:

- High inflation: Rising prices for goods and services affect both consumers and businesses.

- High interest rates: The Fed typically raises interest rates to slow down borrowing and spending.

- Limited availability of labor: Businesses struggle to find qualified workers as the unemployment rate falls to very low levels.

- Increased investment risk: Investors may become hesitant as they anticipate economic slowdown.

Real-world example: The peak of the U.S. business cycle in 2007 was characterized by a booming housing market, low interest rates, and robust consumer spending. However, mounting debt levels and unsustainable housing valuations eventually led to the financial crisis of 2008.

Image: f15.beauty

3. Contraction (Recession)

The contraction phase, also known as recession, is defined by declining economic activity. This is a period of economic slowdown, marked by falling production, rising unemployment, and decreasing consumer spending. The contraction phase can be triggered by various factors, including a decline in consumer confidence, a sharp rise in interest rates, or a major economic shock, like a pandemic or a global trade war.

- Key indicators:

- Falling GDP: The value of goods and services produced decreases, indicating a declining economy.

- Rising unemployment: Companies lay off workers as demand for their products falls.

- Falling stock prices: Investor confidence wanes, leading to a decline in stock valuations.

- Decreased consumer confidence: People are more cautious with their spending, resulting in a slowdown of economic activity.

Real-world example: The Great Recession of 2007-2009 was a severe contraction phase. The housing bubble burst, setting off a chain reaction that led to a financial crisis and a sharp decline in economic activity.

4. Trough

The trough represents the lowest point of the business cycle. It’s the period of deepest economic decline, when the downturn has run its course and the economy is poised to start recovering. The trough is typically characterized by low consumer confidence, high unemployment, and subdued business investment. However, it’s also a time when companies may seek new opportunities and government intervention often plays a critical role in stimulating economic growth.

- Key indicators:

- Low output and production: Businesses are operating at reduced capacity.

- High unemployment: Many workers remain unemployed as demand for labor remains low.

- Low interest rates: Central banks lower interest rates to incentivize borrowing and spending.

- Government intervention: Governments often use fiscal policy (spending and taxes) and monetary policy (interest rates) to stimulate the economy.

Real-world example: The trough of the Great Depression in the 1930s was a period of intense economic hardship, with unemployment exceeding 25%. Government intervention through programs like the New Deal played a crucial role in stimulating economic recovery.

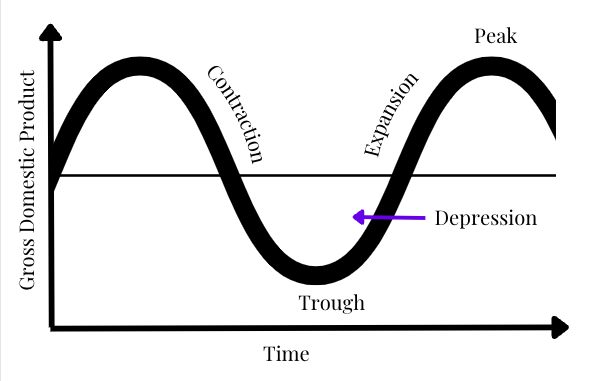

The Business Cycle: A Visual Representation

[insert diagram here: Simple, clear line chart depicting the 4 phases of the business cycle: Expansion, Peak, Contraction, Trough]

This diagram illustrates the typical pattern of the business cycle. It doesn’t account for the unpredictable nature of economic events but helps visualize the rhythmic movement of the economy.

Understanding the Business Cycle’s Impact

The business cycle affects us all. As individuals, we see the impact in our wallets when prices rise during periods of economic expansion, or when job opportunities dwindle during contractions. Businesses are significantly affected by the business cycle, adjusting their operations, investment, and hiring strategies to navigate the economic landscape. Government policymakers also pay close attention to the business cycle, using various tools to moderate its fluctuations and ensure sustainable economic growth.

The Interplay of Factors

The business cycle is influenced by a complex interplay of factors, including:

- Consumer confidence and spending: When consumers are optimistic about the future, they tend to spend more, boosting economic activity. Conversely, declining consumer confidence can trigger a recession.

- Interest rates: The Federal Reserve uses interest rate adjustments to influence borrowing and spending. Higher interest rates can curb borrowing and slow economic activity, while lower interest rates can stimulate investment and growth.

- Government policy: Government spending, taxation, and regulations can significantly influence the business cycle.

- Technological innovation: Major technological breakthroughs can drive economic expansion.

- Global economic conditions: The global economy is interconnected, and events in one region can impact others.

Navigating the Business Cycle

Understanding the business cycle is essential for making informed decisions, whether you’re an individual managing your finances, a business adjusting its operations, or a government policymaker shaping the economy.

- Individuals: Being aware of the business cycle can help you adjust your spending habits, save for a rainy day (when a recession occurs), and invest wisely.

- Businesses: Companies need to be flexible and adaptable to the changing economic conditions. This may mean adjusting production levels, inventory, pricing, and marketing strategies to optimize operations throughout the cycle.

- Governments: Policymakers use a range of tools, including fiscal and monetary policy, to moderate the business cycle and achieve economic stability.

The Long-Term View

While the business cycle inevitably involves fluctuations, focusing on the long-term trend is crucial. The economy generally experiences growth over the long term, as technological advancements and productivity improvements drive progress. However, understanding the ebbs and flows of the business cycle is essential for navigating the short-term challenges and opportunities that arise along the way.

4 Phases Of Business Cycle With Diagram

https://youtube.com/watch?v=GGc4LejFUdk

Conclusion

The business cycle, with its predictable phases of expansion, peak, contraction, and trough, is a fundamental reality of economic life. Understanding its nuances allows us to anticipate economic trends, make informed decisions, and prepare for the inevitable ups and downs. By embracing the cyclical nature of economic activity, we can navigate the journey more effectively, building resilience and striving for long-term prosperity.