Imagine this: You’ve just received a substantial inheritance, or maybe you’re finally ready to invest in that dream property. The excitement bubbles within you, but then a sudden wave of uncertainty washes over you. How do you manage this influx of funds safely and efficiently? This is where a Bank of America Letter of Instruction comes into play, a powerful tool that can provide clarity and control over your financial journey.

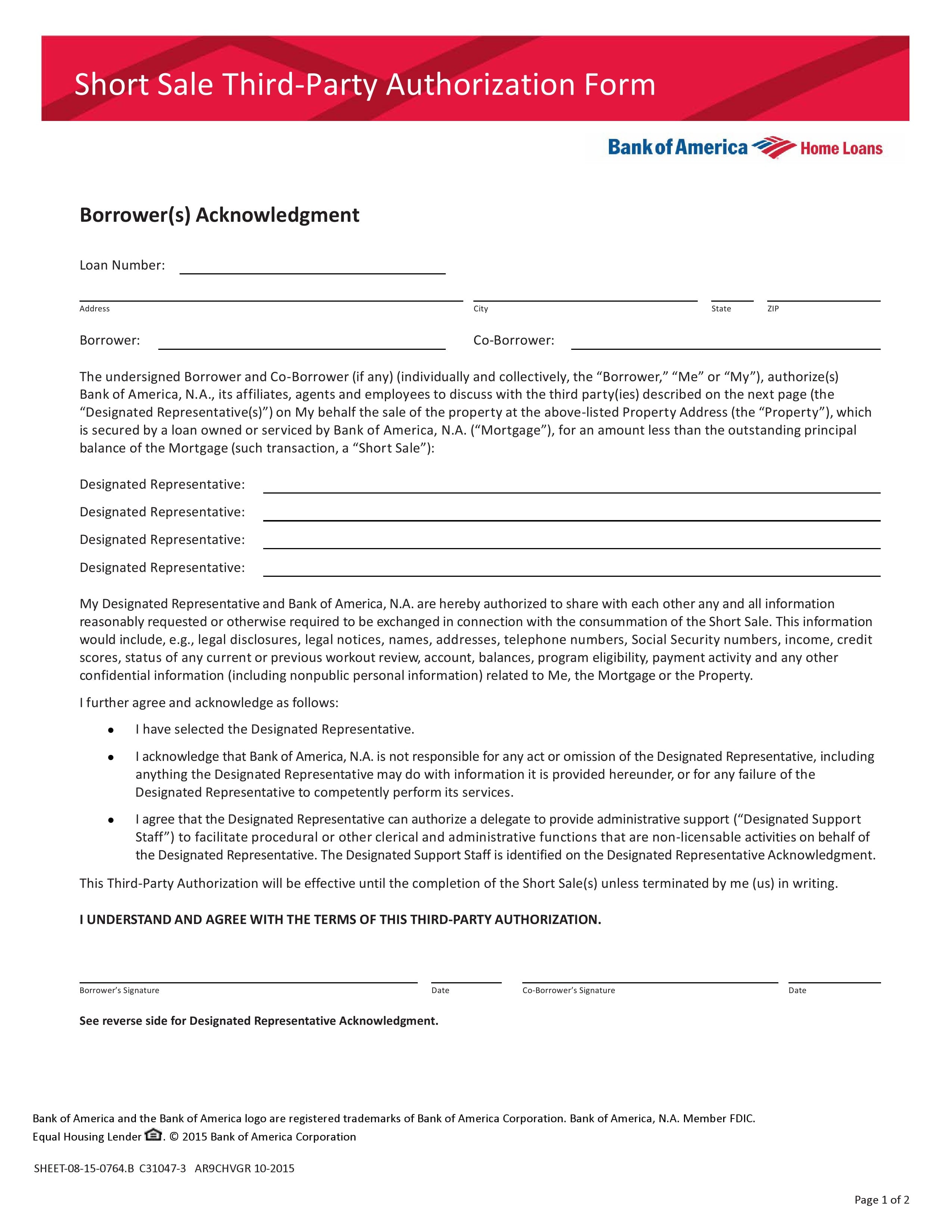

Image: formdownload.org

A Bank of America Letter of Instruction is essentially a written document that outlines your specific instructions for handling your funds. It’s like a blueprint for your financial wellbeing, ensuring that your wishes are understood and followed by the bank. But this isn’t just about managing significant sums; it can be used for diverse financial needs, from setting up automatic transfers to ensuring that loved ones have access to your accounts in emergency situations. It’s about taking charge and ensuring peace of mind in your financial life.

Understanding the Power of a Bank of America Letter of Instruction

The essence of a Bank of America Letter of Instruction lies in its clarity and control. It’s not a generic form; it’s a personalized document tailored to your unique circumstances and financial goals. Imagine it as a bridge between your wishes and the bank’s actions, ensuring that your money is managed in accordance with your desires. The structure of a Letter of Instruction generally includes sections outlining:

1. Account Details:

- Clearly state the account(s) you’re referring to, including account numbers and types.

- Be specific about the funds involved, whether it’s a specific amount or a percentage of your balance.

2. Instructions:

- Clearly articulate your desired actions. This might involve:

- Transfers to other accounts (internal or external)

- Investments in specific financial instruments

- Payments to beneficiaries or creditors

- Establishing automatic bill payments

Image: www.pinterest.com

3. Timeframe:

- Specify the duration of your instructions. Should they be carried out immediately, at a specific date, or follow a specific schedule?

- For instance, you might want to set up automatic monthly payments for bills or schedule a one-time transfer for a specific date.

4. Signature:

- Sign and date your Letter of Instruction in front of a witness to ensure its authenticity and legality.

Beyond Simple Transfers: Unlocking the True Potential

While a Bank of America Letter of Instruction might be perceived as a mere tool for transferring funds, it holds much more than meets the eye. It’s a powerful instrument for managing your finances with precision and control, addressing unique situations that go beyond simple transfers:

1. Ensuring Funds for Loved Ones:

- In times of crisis or incapacity, a Letter of Instruction can empower your loved ones to access your funds.

- Clearly indicate trusted individuals and empower them to manage your finances on your behalf.

2. Establishing Trusts and Estates:

- Use it to specify how your assets should be distributed upon your passing.

- Designate beneficiaries for your accounts or outline how your assets will be managed within your estate.

3. Managing Investments:

- Detail your investment strategy, including specific instruments you wish to invest in, risk tolerance levels, and investment goals.

- This ensures your funds are allocated according to your vision, even if you’re unable to actively manage your portfolio.

4. Facilitating Recurring Payments:

- Automate your monthly bills, ensuring on-time payments and reducing the risk of late charges.

- Set up recurring transfers to savings accounts or investment accounts, building financial discipline and achieving your long-term goals.

Trustworthiness and Security: Your Assurance

As you navigate the world of financial management, trust and security are paramount. Recognizing this, Bank of America prioritizes the utmost care for your Letter of Instruction:

- Security Measures: Robust security measures are in place to protect your instructions from unauthorized access and manipulation.

- Compliance: The bank adheres to stringent legal and regulatory frameworks ensuring the legitimacy of your instructions.

- Dedicated Support: Bank of America provides dedicated support teams for handling your Letter of Instruction, ensuring that your requests are accurately fulfilled.

Navigating the Process: A Step-by-Step Guide

While the idea of a Bank of America Letter of Instruction might seem daunting, the process itself is quite straightforward:

- Consult with a Bank Representative: Schedule an appointment with a knowledgeable representative to discuss your personal needs and financial goals. They’ll guide you through the process and ensure your instructions are clearly defined.

- Review and Finalize the Letter: Carefully review the draft of your letter, scrutinizing every detail to ensure accuracy and consistency with your intentions.

- Sign and Witness: Sign and date your Letter of Instruction in front of a witness to ensure its legal validity. The bank will retain a copy for their records, while you’ll receive a copy for your own reference.

Leveraging Expertise: Insights from Financial Professionals

Financial experts recommend the use of a Bank of America Letter of Instruction for various reasons:

- Financial Security: It provides peace of mind, knowing that your wishes will be followed in the event of an emergency or incapacitation.

- Streamlined Processes: Reduces the burden on loved ones, enabling them to manage your finances efficiently in your absence.

- Clear Communication: It eliminates ambiguity and ensures that your desires are clearly and unequivocally communicated to the bank.

Bank Of America Letter Of Instruction

Taking Control: Your Path to Financial Empowerment

A Bank of America Letter of Instruction empowers you, enabling you to take control of your financial journey. It’s not just about managing funds; it’s about ensuring that your financial future aligns with your goals and aspirations.

Reach out to Bank of America today to learn more about this invaluable tool and embark on a journey of financial empowerment and peace of mind.