Imagine this: you’ve delivered a service to a client, but they haven’t paid you yet. You’ve earned the income, but it’s not reflected on your financial statements. This is a tricky situation, but one that’s easily addressed with a simple accounting adjustment: the adjusting entry for accrued revenues. This entry ensures that your financial statements accurately reflect the reality of your business – a picture of your revenues that includes both earned and unearned income.

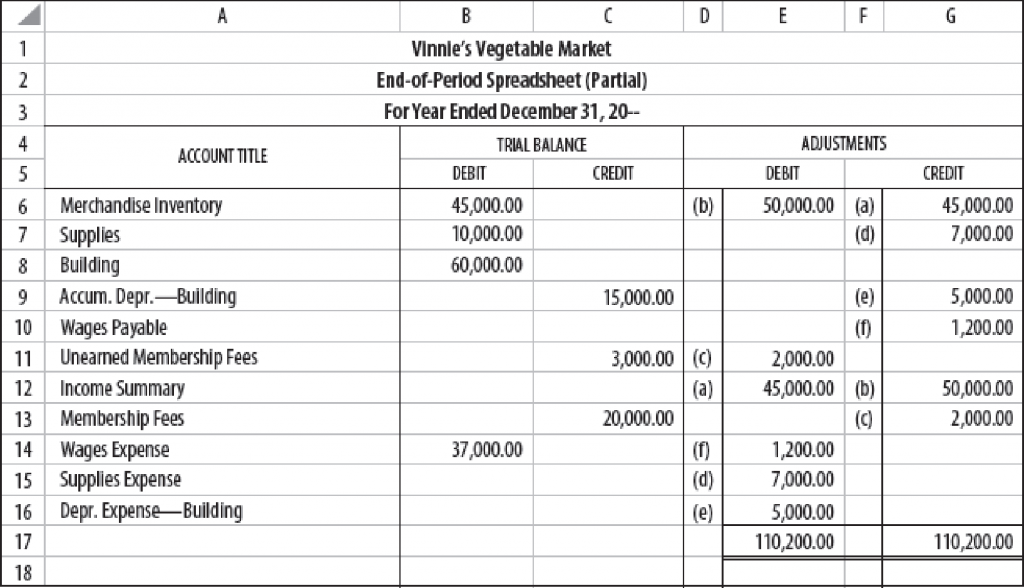

Image: lizethkruwsmith.blogspot.com

But let’s take a step back and understand the concept of accrued revenue before we delve into the intricacies of the adjusting entry. In essence, accrued revenue represents income you’ve earned but haven’t yet received. It’s like a promise of payment, a future cash inflow that is still pending. This is where the adjusting entry comes into play – it bridges the gap between what you’ve earned and what’s reflected on your books.

Accrued Revenue: A Closer Look

Accrued revenue arises from various situations. Consider the scenarios below:

- Service-based businesses: A web design agency may have completed a website design for a client but hasn’t received payment yet. The service has been delivered, the work has been completed, and the agency has earned the income.

- Subscription-based models: A software company may receive payment for a year’s subscription upfront. Although they receive the entire payment at once, they earn the revenue gradually over the course of the year.

- Recurring revenue: A gym membership requires a monthly fee. Even though the payment is made each month, the gym has earned the revenue for the entire month, even though they haven’t provided all the services yet.

These situations highlight the need for adjusting entries. Without them, your financial statements wouldn’t accurately portray your financial situation.

The Balancing Act: Understanding the Adjusting Entry

The adjusting entry for accrued revenue serves to bring your financial statements into alignment with the true financial reality of your business. It involves two key accounts:

- Accrued Revenue: This account serves as a placeholder for the revenue you’ve earned but not yet received. It’s a liability account, indicating an obligation to provide the services or products in the future.

- Revenue: This account reflects the income generated from your business operations.

The adjusting entry involves debiting the accrued revenue account and crediting the revenue account. This equates to a simple mathematical equation:

Debit Accrued Revenue = Credit Revenue

The Golden Rule of Accounting: When applying the adjusting entry, remember the golden rule of accounting: “Debits increase asset, expense, and dividend accounts, while credits increase liability, owner’s equity and revenue accounts.”

A Step-by-Step Guide: Creating the Adjusting Entry

Let’s break down the process of creating this entry step by step. Let’s imagine our web design agency has completed a website for a client and is owed $5,000.

1. Identify the Accrued Revenue: You’ve earned the income, but haven’t received it yet.

2. Determine the Revenue Amount: The revenue amount is $5,000, the amount you’re owed for the website design.

3. Analyze the Accounts Impacted: The accrued revenue account increases (a liability), while the revenue account also increases.

4. Debit Accrued Revenue, Credit Revenue: The journal entry would look like this:

Debit: Accrued Revenue $5,000

Credit: Revenue $5,000

Image: accountingsoftworks.com

The Importance of Accrued Revenue: Don’t Neglect the Details

It’s easy to overlook the importance of accrued revenues, especially in the early stages of your entrepreneurial journey. However, here are compelling reasons to prioritize this critical aspect of accounting:

-

Accurate Financial Reporting: Accrued revenue ensures your financials are accurate, providing a reliable snapshot of your financial health.

-

Tax Compliance: Accrued revenue is crucial for accurate tax filings. It prevents over-reporting or under-reporting of taxable income.

-

Effective Budgeting: Understanding accrued revenue helps you make informed budgeting decisions, recognizing future cash inflows based on earned income.

-

Investor Confidence: Accurate financial statements, including the proper accounting of accrued revenue, build trust with potential investors.

Accrued Revenue: Beyond the Basics

While the adjusting entry for accrued revenue is a basic accounting principle, there are nuances to consider:

- Estimating Accrued Revenue: In some cases, accurately determining the accrued revenue amount can be challenging. For example, in the case of a subscription service, the revenue for a month hasn’t entirely been earned unless the service is fully delivered. In these situations, estimations are necessary.

- Matching Principle: The concept of accrued revenue is deeply connected to the matching principle in accounting, which dictates that expenses should be matched with the revenue they helped generate.

- Timing: It’s essential to record the adjusting entry for accrued revenue at the end of each accounting period, typically monthly, quarterly, or annually.

Expert Insights: Pro-Tips for Success

- Consult a Professional: While the concept is simple, the application can be complex. Consult a qualified accountant or CPA for guidance and ensure your entries are accurate.

- Regular Review: Make it a practice to regularly review your accrued revenue entries and update them as needed.

2. The Adjusting Entry For Accrued Revenues

Conclusion

The adjusting entry for accrued revenue is a vital step in ensuring your financial statements are accurate, transparent, and reflect the true financial reality of your business. By recording this entry, you create a clear picture of your earnings, regardless of when you receive your cash payments.

This process might seem like a mere technicality, but it’s a crucial element in building a solid foundation for your business. By mastering this simple yet impactful accounting principle, you can gain valuable insights into your company’s financial health, attract investors, and navigate the complexities of managing your business with confidence.