Have you ever wondered what those seemingly random numbers on your checks or bank slips mean? These mysterious sequences – often referred to as routing numbers – hold the key to the smooth flow of money in the banking system. For Royal Bank of Canada (RBC) clients, understanding routing numbers is essential for managing their finances effectively. This article delves deep into the world of RBC routing numbers, exploring their significance, functionality, and how they impact your transactions.

Image: cansumer.ca

Think of routing numbers as the addresses of the banking world. They act as unique identifiers, guiding financial institutions in directing money transfers efficiently. In the context of RBC, routing numbers are crucial for various transactions – from transferring funds between accounts to receiving payments from businesses or individuals.

Deciphering the Code: Understanding RBC Routing Numbers

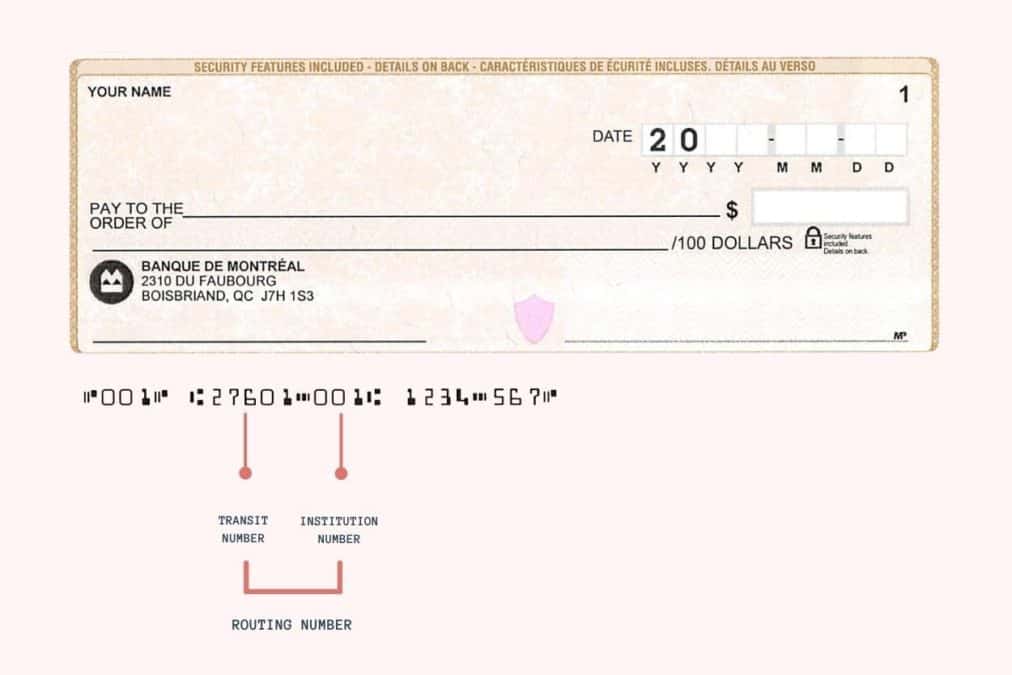

RBC routing numbers, also known as transit numbers in Canada, are nine-digit sequences that play a pivotal role in identifying specific branches of the bank. Though each bank has its own unique master routing number, a branch-level identifier allows for precise location targeting. This system ensures that your money reaches the intended recipient, even across multiple branches.

The Anatomy of an RBC Routing Number

Every RBC routing number follows a consistent format, offering insight into its function:

- First 3 Digits: These digits represent the “Bank Identification Number” and are specific to Royal Bank of Canada. They are always the same regardless of the branch.

- Next 3 Digits: These digits indicate the specific branch within RBC.

- Last 3 Digits: This portion of the routing number represents the “Branch Identification Number.”

Where to Find Your RBC Routing Number

Knowing where to find your RBC routing number simplifies your financial management and ensures accurate transactions. Here are the most common locations:

- RBC Website: Through online banking platforms and secure websites, you can access your routing number for the specific account you’re managing. In most cases, this information is readily available within the account settings or transaction details.

- RBC Mobile App: If you leverage the RBC mobile app, your routing number is usually accessible within your account information or transaction history.

- RBC Bank Statements: Your bank statements clearly display your routing number, often printed directly on the statement or readily available within the document.

- RBC Checks: The routing number is prominently printed in the top-left corner of your RBC checks, ensuring the correct transfer of funds.

Image: www.savvynewcanadians.com

Utilizing Your RBC Routing Number: Common Applications

Once you’ve located your routing number, you can utilize it for various financial transactions:

- Online Bill Payments: When paying bills online, you’ll need to provide your routing number, account number, and the amount to be paid. Many online payment systems require these details for secure and efficient transactions.

- Wire Transfers: If you’re sending funds to another individual or business account, you’ll need to provide your routing number to facilitate the transfer. Wire transfers often utilize routing numbers for accurate and timely payments.

- Direct Deposits: When setting up direct deposits for your paycheck or other income, you need to provide your routing number and account number to ensure the funds are deposited directly into your RBC account.

- Bank Transfers: When transferring funds from one RBC account to another, your routing number will be necessary, ensuring that the funds are directed to the correct recipient.

Beyond the Basics: Exploring the Importance of Routing Numbers

While the concept of routing numbers may seem straightforward, their implications are far-reaching. These numbers are vital in underpinning the financial infrastructure of Canada, enabling smooth and secure transactions between individuals and businesses.

- Financial Security: Routing numbers play a crucial role in protecting financial information, ensuring that transfers are directed to the intended recipients. They act as a check and balance system, safeguarding against unauthorized transactions.

- Transaction Efficiency: By leveraging routing numbers, financial institutions can streamline the transfer of funds, providing swift and efficient transactions for both individuals and businesses. This efficiency contributes to a flourishing financial economy.

- Inter-Bank Communication: Routing numbers bridge the gap between different financial institutions, allowing seamless transfers of funds even across different banks. These numbers foster a unified financial ecosystem throughout Canada.

Staying Informed: Latest Developments in RBC Routing Numbers

The banking landscape is constantly evolving, and so are the systems supporting it. While RBC routing numbers remain a critical component of financial transactions, several advancements influence their utilization and implications:

- Digital Transformation: With the increasing popularity of online banking and mobile apps, the reliance on physical checks and traditional banking procedures is diminishing. This trend has fostered a greater awareness of routing numbers and their importance in managing finances digitally.

- Enhanced Security Measures: Financial institutions are constantly implementing new security protocols and encryption methods to safeguard transactions. This commitment to cybersecurity translates to greater confidence in the integrity of routing numbers and the security of your financial data.

- Technological Innovations: The emergence of blockchain technology and other innovations may disrupt the traditional use of routing numbers, introducing new and potentially more secure mechanisms for financial transactions. While these technologies are still evolving, they highlight the dynamic nature of the financial landscape and the potential for change in how we manage money in the future.

Royal Bank Of Canada Routing Number

Conclusion: Navigating the World of RBC Routing Numbers

Understanding the significance of RBC routing numbers is crucial for navigating the complexities of modern finance. These nine-digit sequences act as unique identifiers, enabling seamless and secure financial transactions. From online bill payments to wire transfers, recognizing and using your routing number ensures that your money reaches the correct destination. By staying informed about the latest developments and innovations in the banking sector, you can confidently manage your RBC accounts and secure your financial well-being.