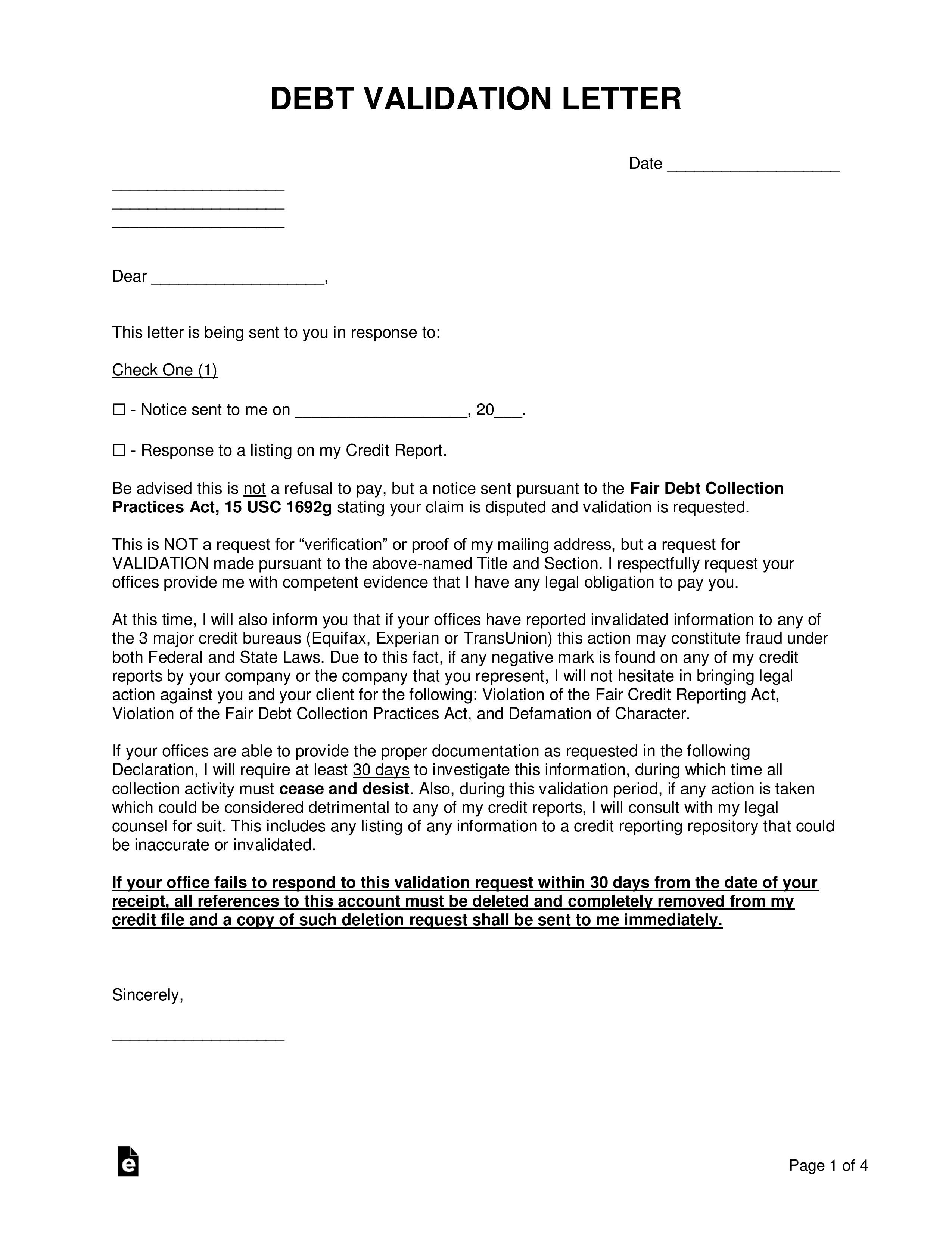

Imagine this: You’re finally ready to buy your dream home, but your credit score isn’t reflecting the reality of your responsible financial habits. It’s frustrating, isn’t it? You’ve paid your bills on time, managed your debt wisely, yet your credit report paints a different picture. This is where a method of verification letter to credit bureaus comes in handy. It’s a powerful tool that can help you correct inaccuracies and boost your score, putting you back on track to achieve your financial goals.

Image: eforms.com

This letter is your voice, challenging questionable information on your credit report. It’s a formal request for a review, giving you the opportunity to set the record straight. Many people underestimate the power of a well-crafted verification letter, but it can be the key to unlocking better credit opportunities.

What is a Method of Verification Letter?

Understanding the Purpose

A method of verification letter is a formal document that you send to a credit bureau to dispute inaccurate information on your credit report. It’s your way of challenging any errors or discrepancies, providing evidence to prove your case. Think of it as a formal petition for a credit report “makeover,” highlighting any mistakes that might be dragging down your score.

Who Needs a Verification Letter?

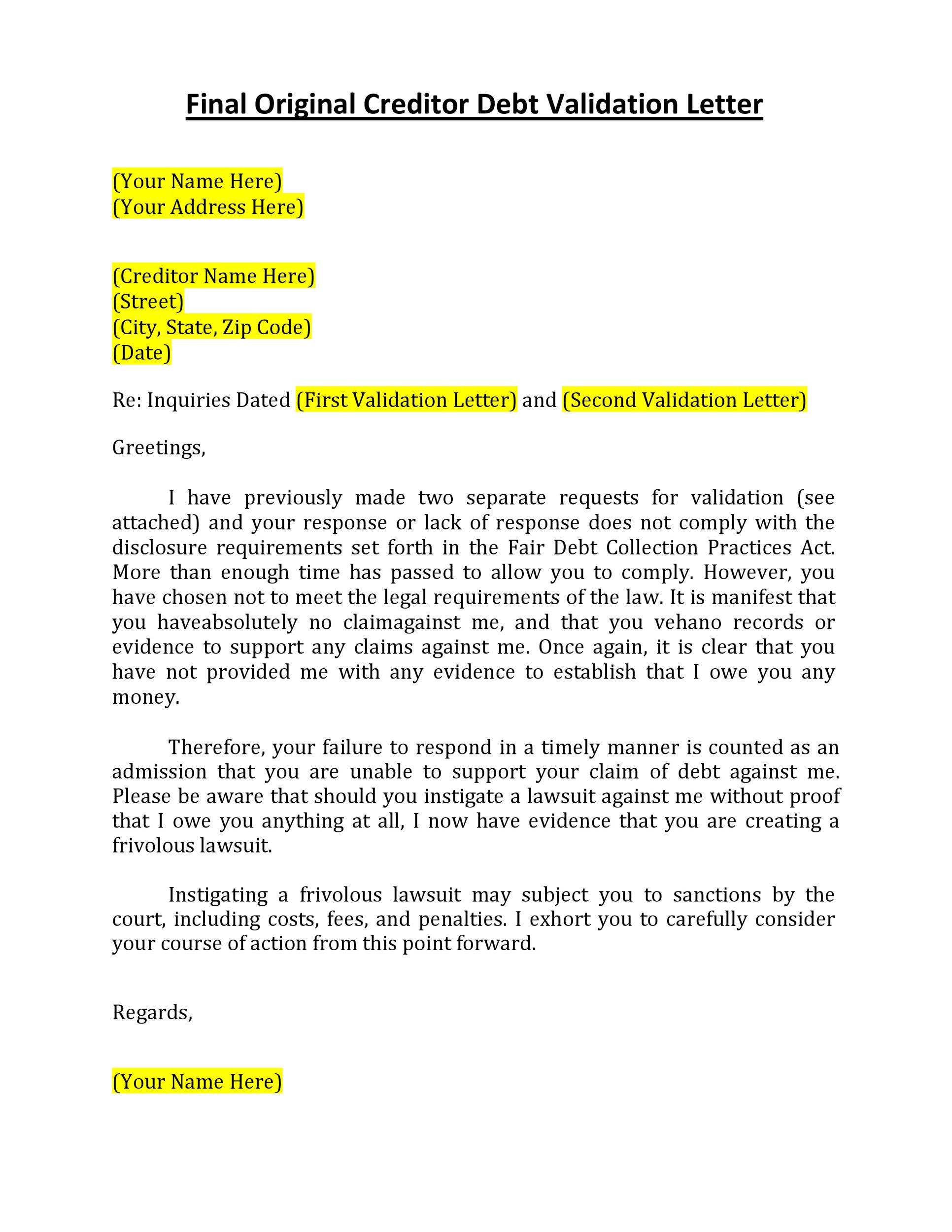

This letter is essential if you find incorrect information on your credit report. It could be a faulty account, a debt that isn’t yours, or an outdated entry. It can also be helpful if you’ve been a victim of identity theft or fraud. In any case, a method of verification letter can be your weapon of choice to fight for a more accurate reflection of your credit history.

Image: mungfali.com

Crafting the Perfect Method of Verification Letter

The success of your letter depends on its clarity, precision, and supporting documentation. You need to provide concrete evidence to back your claims, convincing the credit bureau that there are discrepancies that need to be addressed. Here’s how to craft a winning method of verification letter:

1. State Your Case Clearly

Begin by stating your purpose clearly and concisely. Let the credit bureau know that you’re disputing certain items on your report. List each specific item you want to contest, providing its account number, date of the alleged error, and the reason for the dispute.

2. Back Up Your Claims

Evidence is king when it comes to method of verification letters. Include supporting documents like canceled checks, receipts, or statements to justify your dispute. If you’re disputing a debt, provide documentation proving that you’ve already paid it or that it’s not your responsibility.

3. Include Contact Information

Don’t forget to leave your contact information, including your full name, address, phone number, and email address. This makes it easy for the credit bureau to reach you for any clarifications or further information. Make sure your contact details are current and accurate.

4. Send to the Right Place

Each credit bureau has its own address for dispute letters. You can find this information on their website. Make sure you send your letter to the correct address to avoid delays in processing.

5. Keep a Copy for Your Records

It’s always a good idea to keep a copy of your letter and any supporting documents for your records. This way, you have a record of the dispute in case you need to follow up later. Plus, it helps to keep track of the process and any deadlines.

Tips for a Successful Verification Letter

Here are some tips that can help you create a persuasive and effective method of verification letter:

1. Be Polite but Assertive

Your tone should be professional and respectful, but also firm. You’re not accusing anyone, but you’re stating your case clearly and seeking a resolution. Avoid slang or jargon, and keep your language concise and understandable.

2. Focus on the Facts

Avoid emotional pleas or personal attacks. Stick to the facts and provide clear evidence to support your claims. The more specific and detailed your letter is, the more convincing it will be.

3. Be Patient and Persistent

It may take some time for the credit bureau to investigate your dispute. Be patient and persistent in following up. If you don’t get a timely response, call them directly to inquire about the status of your dispute.

FAQs about Method of Verification Letter

**Q: What happens if the credit bureau doesn’t investigate my dispute?**

**A:** If the credit bureau fails to investigate your dispute within a reasonable timeframe, you can contact the Consumer Financial Protection Bureau (CFPB) or your state attorney general for help.

**Q: Can I dispute multiple items on my credit report with one letter?**

**A:** Yes, you can dispute multiple items with a single letter, but it’s advisable to list each item clearly and provide separate supporting documentation for each. This helps to organize your case and makes it easier for the credit bureau to process your request.

**Q: Is there a time limit for filing a dispute?**

**A:** There is no set time limit, but it’s best to file your dispute as soon as you discover any errors on your credit report. The sooner you act, the better your chances of getting the issue resolved.

Method Of Verification Letter To Credit Bureau

Conclusion

A method of verification letter is a powerful tool for correcting inaccuracies on your credit report and improving your credit score. It’s your way to challenge incorrect information, providing evidence to support your claims and ensure a more accurate representation of your financial history. By crafting a well-written, detailed letter and following up diligently, you can navigate the path towards a healthier credit score and financial stability.

Are you ready to take control of your credit report and explore the benefits of a method of verification letter? Let us know in the comments below! We’re here to help you on your journey to financial empowerment.